- The FinOak

- Posts

- Billionaires' Plummeting Wealth: Ruin of the Tech Sector in 2022

Billionaires' Plummeting Wealth: Ruin of the Tech Sector in 2022

Billionaires' Plummeting Wealth: Ruin of the Tech Sector in 2022

Hello, FinOak readers! We at FinOak wishes everyone a very Happy New Year and hope the best for all.In the weekly wrap up, we have covered about the fall in the wealth of the big shots and have tried to evaluate reasons for the same and have talked about yet another controversial IPO of MamaEarth which speculators believe can be the next Paytm. For the personal finance column this time we have talked about EPF and PPF and which scheme is suitable for whom. Next we have covered about the lucrative interest rates give by small finance banks which can be a good option to consider to diversify one's portfolio.For Featuring Future Leaders column, this time we have our very own Riya Ahuja, one of the Co-founders at FinOak. Read her inspiring story to know about how she steered her career path from finance to marketing and successfully bagged a job at Hindustan Unilever Limited.

Column 1

Weekly Wrap Up

In today’s Edition

Fall in the Wealth of Tech Giants

MamaEarth IPO, another Paytm in the making?

1. Fall in the wealth of Tech Giants

What if we tell you that in 2022, World’s 500 Richest Billionaires lost $1.4 Trillion in a Year (according to the Bloomberg Billionaires Index)

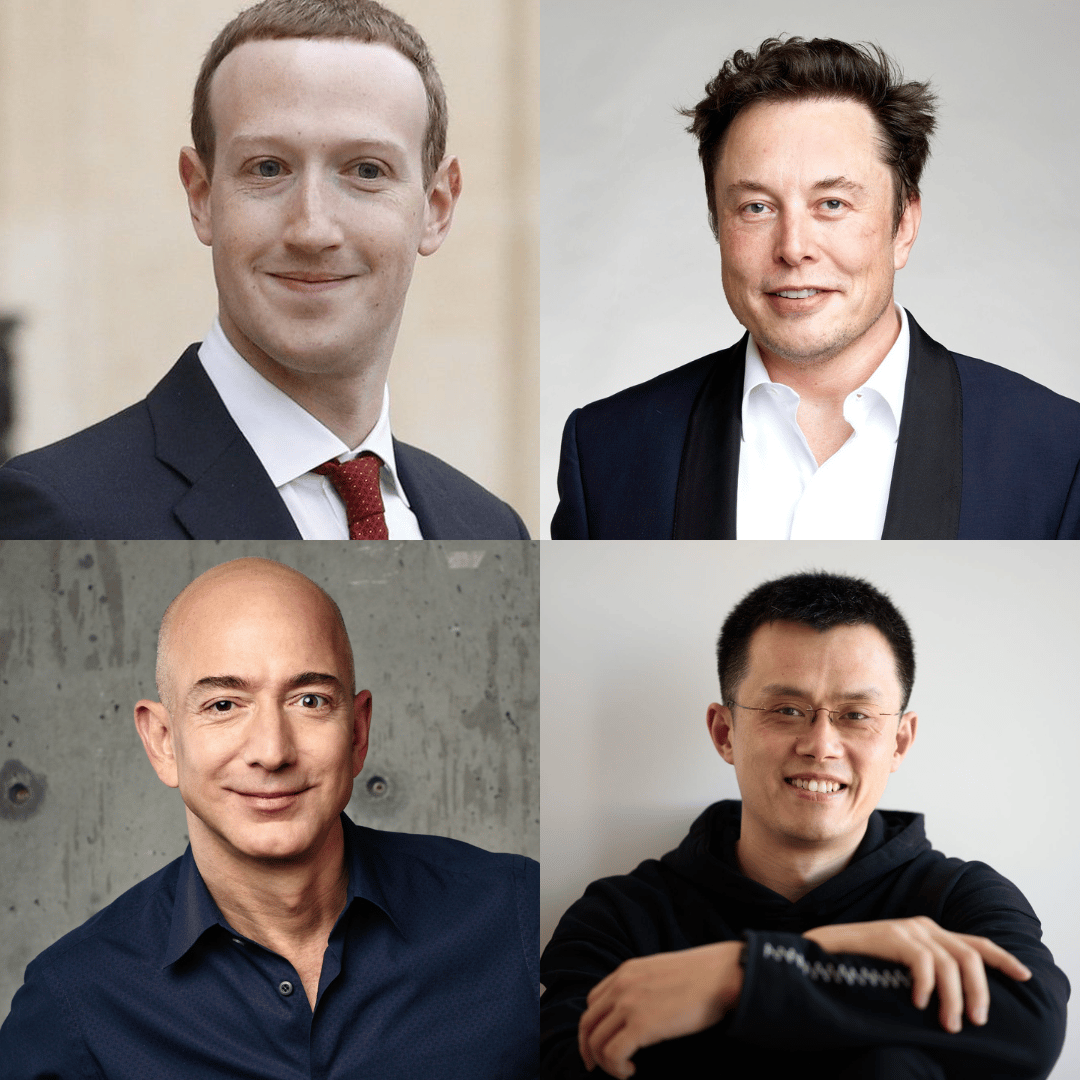

The fortunes of Silicon Valley billionaires took a beating in 2022 as share prices of the world's tech giants plummeted. Some lost their wealth due to their own self-inflicted actions while some billionaires lost the money due to widespread inflation and aggressive central bank decisions and reforms. Combined with a backdrop of widespread inflation and aggressive central bank tightening, the year was a dramatic comedown for a group of billionaires whose fortunes swelled to unfathomable heights in the Covid era of easy money. In most cases, the bigger the rise, the more dramatic the fall: Elon Musk, Jeff Bezos, Changpeng Zhao and Mark Zuckerberg alone saw some $392 billion erased from their cumulative net worth.

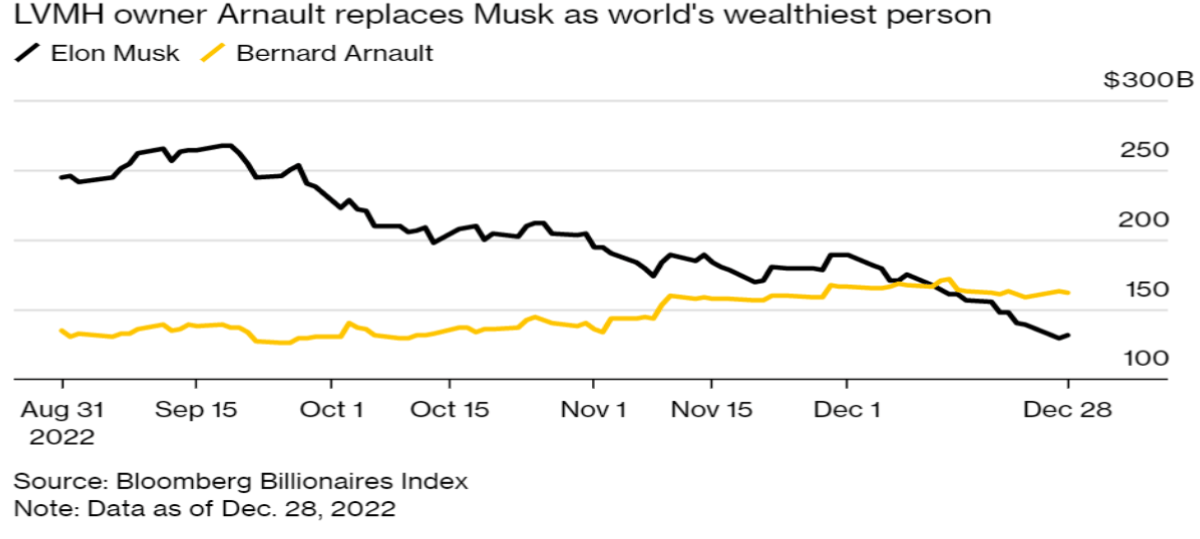

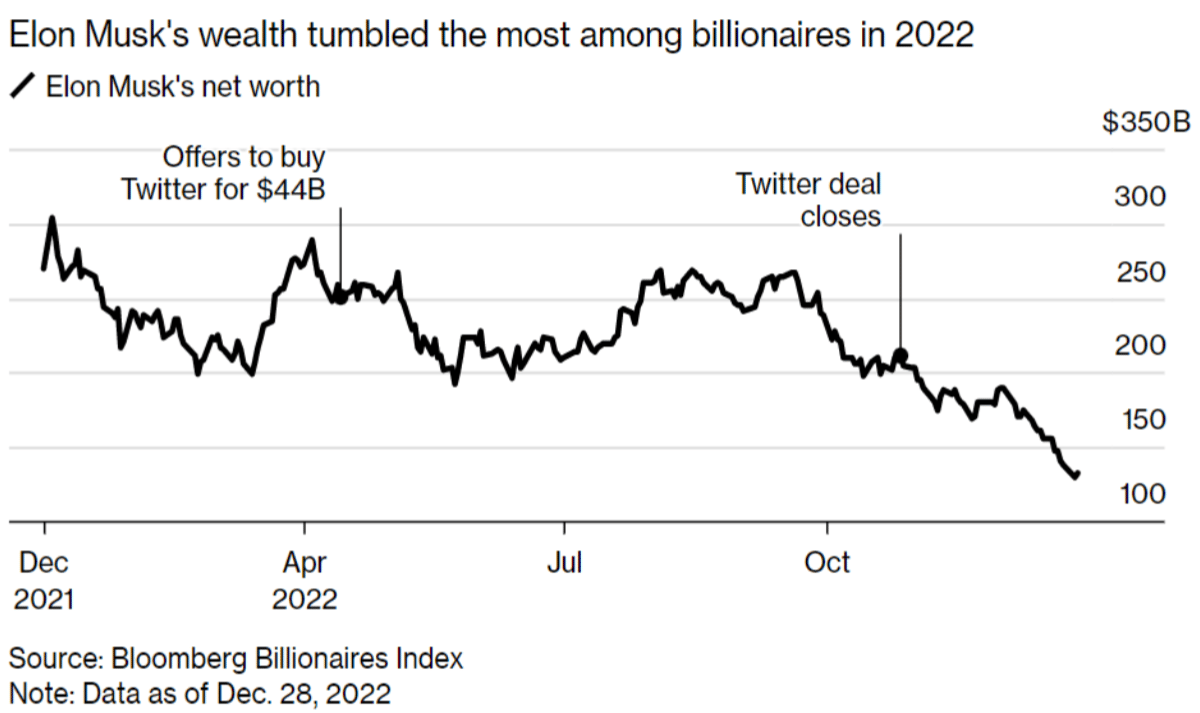

Once the darling of Wall Street investors, Tesla is having a tough time after their stocks saw a major drop after its boss, Elon Musk acquired Twitter for a whooping $44 Billion and his recent decisions at San Francisco headquartered social media company. The Tesla and SpaceX boss saw over half of his net worth evaporate this year, boosting France's luxury goods mogul Bernard Arnault into the top spot. Musk largely financed his $44 billion buyout of Twitter by selling off shares in Tesla, putting the share price into an even steeper downward spiral.

2022 has been a year of dramatic changes, with Elon Musk acquiring Twitter in October after Elon Musk made an offer to buy Twitter in April 2022, which in hindsight, led to a loss of a billion dollars. Binance CEO Zhao, known as CZ in the crypto world, has seen his net worth plummet by about $84 billion in 2022.

Quest for Metaverse saw the share price of Meta, Facebook’s parent company Wall Street's lack of confidence, have sliced approx $81 billion off of Zuckerberg's fortune with current wealth of $47.2 Billion.

Jeff Bezos, the founder of the multinational eCommerce platform, Amazon, witnessed his total net worth going down by $85 billion in 2022. Mr Bezos suffered huge erosion in net worth as stocks of Amazon tumbled by nearly 80 per cent in 2022. The reason behind this is high inflation rates in the global economy which increased the cost of living in numerous major economies. Customers started spending less on e-commerce platforms such as Amazon in order to save up money. This had a significant impact on sales on Amazon. Decreased revenue from advertisements also had made the stock look less attractive in the market. This pushed down the stock prices.Let's see what will be the 2023 outlook for the global tech sector amidst the innovations like chatGPT. Will the pattern be reversed or will it be worse pertaining to the recession warnings.

2. MamaEarth IPO, another Paytm in the making?

Mamaearth, which was founded in 2016, co-founded by former Shark tank India judge Ghazal Alagh and her spouse Varun Alagh, has become a hit in India with its line of "toxin-free" products such as face washes, shampoos, and hair oils, and is a leading player in the burgeoning personal care industry alongside Unilever, which is comparable to the India division of the Procter & Gamble Company.

Mamaearth’s company's last valuation was $1.2 billion in January 2022; however, havoc struck when, a year later (2023), it is now being valued at $3 billion/ Rs. 24,000 cr for its upcoming IPO

What is the concern?

Experts and investors are warning against such a high valuation in light of what has happened to the stocks of many new-age internet start-ups that have recently listed on bourses, including Paytm, Nykaa, and Zomato. All of these companies suffered massive losses. Given the market's sluggishness, many companies, including Snapdeal, have delayed or cancelled their IPO plans.

Acc. to Hosana’s DHRP( IPO documents), Mamaearth’s parent company the valuation that is is being asked is 17x of their FY23 Revenues (H1-FY23 Revenues of Rs 722 cr *2) and 26x of their FY22 Revenues of Rs 943 cr. It's at a P/E ratio of 3400x (considering H1-FY23 PAT of Rs 3.67 cr * 2) and 1700X considering FY22 PAT of 14.44 cr.

At this P/E ratio, Mamaearth will have to grow at least 50 times (in profits) to deserve the current valuation. This unrealistically 𝗛𝗶𝗴𝗵 𝗥𝗲𝘃𝗲𝗻𝘂𝗲 𝗠𝘂𝗹𝘁𝗶𝗽𝗹𝗲 is not only thing that got caught my attention.

"For FY2020, 2021, and 2022 and the six-month period ended September 30, 2022, our revenue from online channels across all our brands amounted to Rs 998.43 million, Rs 3,742.93 million, Rs 6,595.34 million, and Rs 4,291.15 million, respectively, representing 90.94%, 81.37%, 69.91%, and 59.37% of our revenue from operations, respectively," the company said in its draft IPO papers.

Ghazal Alagh, co-founder of Mamaearth, said on Wednesday that the company has not quoted or subscribed to the valuation numbers circulating on social media, clearing the air on the firm's valuation for its initial public offering (IPO).

In response to these concerns, co-founder Gazal Alagh sets the record straight in a series of tweets. Alagh said this evaluation was not mentioned in the DRHP(Draft Red Herring Prospectus), which is standard practice. "Determining a valuation is a process that takes place over time as we engage in deeper discussions with our investor community," she continued regarding the controversial ratings, which she flatly denied, saying, "Mama Earth does not quote or subscribe to ratings that are making the rounds on social media. IPO.

"We have not quoted or subscribed to the valuation numbers that are being mentioned in various posts on social media," the personal care products start-up’s co-founder wrote in a series of tweets. Alagh went on to say, "Valuation discovery is a process that will take place over time as we engage in deeper conversations with the investor community."

Since Honasa Consumer Ltd., which owns new-age FMCG brands like Mamaearth and The Derma Co., filed papers with capital markets regulator SEBI to raise funds through an IPO, citizens have raised valuation concerns. "Disastrous" and "extortion" were some of the words used to describe the valuation demand on Twitter.

Column 2

In today’s Edition

EPF vs PPF: Where should you invest?

Fixed Deposits can now provide returns upto 8.5%

1. EPF vs PPF: Where should you invest?

If you are in your late teens or twenties, you must have wondered what the difference between EPF and PPF is and which investing choice is preferable. In this edition of the newsletter, we will go deeper and determine which option is better for you.

As you may know, EPF (Employee Provident Fund) and PPF (Public Provident Fund) are two financial instruments developed by the government to encourage the practice of saving among Indians and are considered safe due to government backing. They are mainly utilised as tax-saving solutions under Section 80C of the Income Tax Act of 1961. EPF is managed by the Employees' Provident Fund Organisation, while PPF comes under the management of post offices and banks.

So, what is the difference between EPF and PPF?

EPF, often known as PF, is a government-backed savings plan designed specifically for organized-sector employees. The employer and employee must contribute 12% of the employee's base salary plus a dearness allowance to this savings plan each month.

Let's understand this with an example.

Suppose your base salary is Rs. 100000/month.

With the EPF scheme

You(Employee) will be required to pay Rs 12000 (12% of your base salary).

And your employer will also pay the same amount, i.e., Rs 12,000.This amount will be bifurcated into contributions made towards EPF and EPS (Employee Pension Scheme)Out of 12%; 8.33% (Rs. 8330) will go towards EPS and 3.67% (Rs. 3670) will go towards EPF.

So, your total EPF investment comes to Rs. 15670/month (Rs 12000 + Rs 3670).

This is how EPF typically works.

The EPF rates are released each year based on the returns earned by the EPF corpus. The current EPF rate of interest is 8.10%.

The money saved in an EPF account can be withdrawn when you retire or change jobs. When an employee changes jobs, the EPF account can be moved from one organization to another.

Contributions paid to an EPF account during the year are tax-free under Section 80C of the Income Tax Act of1961. Furthermore, the interest and amount earned through superannuation are tax-free. However, if a person withdraws more than Rs. 50,000 from their EPF account before completing 5 years of service, the sum is subject to 10% TDS.

PPF, on the other hand, is a government-backed savings plan that allows those working in the unorganized sector, as well as self-employed, unemployed, and retired people, to invest. This sort of investment is optional, and anyone can give whatever amount they like. PPF investments can be made monthly, quarterly, or yearly. Every year, a minimum of Rs 500 and a maximum of Rs 1.5 lakh can be invested in PPF per financial year. The current PPF rate of interest is 7.10%.

Partial withdrawals from PPF accounts are not permitted until 5 years after the account is opened. Furthermore, the 15-year lock-in period prevents withdrawals from PPF accounts, even in the case of unemployment or monetary needs due to a family emergency.

Section 80C exempts from tax any contributions made in a calendar year up to Rs. 1.5 lakh. Furthermore, both the interest and the maturity value are tax-free in the year of withdrawal.

Which is the better option, PPF or EPF?

EPF is a great option for salaried employees since it includes employer contributions and provides better liquidity. One of the major advantages of EPF is that it is transferable between employers, and partial withdrawals are permitted under certain conditions. EPF eliminates the need to deposit money from a savings account because it is withdrawn immediately from your salary. One disadvantage of EPF is that monthly contributions are required.

PPF is perfect for entrepreneurs, self-employed persons, and anyone working in the unorganized sector. It provides much-needed relief because you can contribute whenever you like. However, the 15-year lock-in term may appear excessive at times. You can borrow against the remaining amount in your PPF account.

Fixed Deposits have traditionally been a popular financial instrument in Indian households. Indians feel that safety, transparency, guaranteed returns, liquidity, and convenience of investing are more essential than the promise of larger returns that come with potential risks.

Fixed deposits, as you may be aware, are assets in which individuals can park a substantial portion of their excess savings and enjoy significant wealth growth. These are not marketable securities. As a result, they do not have the same risks as mutual funds or stocks.

Recently, after the Reserve Bank of India (RBI) raised the repo rate, banks began raising interest rates on fixed deposits (FDs) as a response. Since then, several banks have raised their FD interest rates, which are now between 5% and 8%. Despite recent increases in fixed deposit interest rates by most big banks, they remain lower than those given by small financing banks.

As discussed previously, the Public Provident Fund (PPF) offers an interest rate of 7.1%, which is lower when compared to FDs from these small financial institutions.

Here is a list of banks that provide interest rates of more than 8%. (Not a Recommendation)

Unity Small Finance Bank

Unity Small Finance Bank provides regular clients with interest rates ranging from 4.5% to 8.50%. It presently offers senior citizens 9% p.a. on fixed deposits with durations of 181 and 501 days, respectively, while retail investors receive 8.50% p.a. for the same terms. It has been recognized by the DICGC, which ensures cumulative deposits of up to 5 lahks deposited by each depositor in each scheduled bank, including fixed deposits, savings, current, and recurring deposits, in the event of a scheduled bank's collapse or merger/amalgamation.

Suryoday Small Finance Bank

Suryoday Small Finance Bank (SFB) has revised the interest rate on fixed deposits of less than 2 crore rupees. Suryoday Small Finance Bank (SFB) presently offers a maximum interest rate of 8.51% p.a. for deposits due in 5 years to the general public and 9.01% p.a. for senior citizens.

Equitas Small Finance Bank

Equitas Small Finance Bank provides fixed deposit interest rates ranging from 3.50% to 8.00% p.a. to the general public and 4.00% to 8.50% p.a. to senior citizens on terms ranging from 7 days to 10 years.

Utkarsh Small Finance Bank

Utkarsh Small Finance Bank has a minimum rate of 8% and a maximum rate of 8.75% for the general public and elderly persons respectively.

Ujjivan Small Finance Bank

Ujjivan Small Finance Bank has a maximum rate of 8% for the general public and 8.75% p.a. for seniors.

Shivalik Small Finance Bank

The general public may get a maximum rate of 7.50% p.a. from Shivalik Small Finance Bank, while senior people can get a maximum rate of 8.00% p.a.

These can be good options to consider when creating an emergency fund. But it is advised to always do your own research before investing in such instruments.

Column 3

Featuring Future Leaders: Riya Ahuja

Hey guys, this is Riya Ahuja. I’m the co-founder of FinOak and a third-year economics student at St. Stephen’s College. I am an incoming management trainee at Hindustan Unilever. I am one of the 16 Bain & Co. True North scholars from the country. I have previously interned at Hindustan Unilever (where I got a PPO) and Urban Company.

Through this newsletter, I plan to share my journey that led me to where I am and I hope that you take away something from this too :)

Co-founding FinOak

During the pandemic, the first thing out of school and before college admissions was getting together with my friends to co-found FinOak. What started as a fun way to stay engaged during the lockdown ended up becoming a huge success and taught me more than any college degree or internship ever could. FinOak forced me to learn everything: Recruit people and build teams (HR), brand the platform and reach our target audience (Marketing), Guide, mentor and impact students (Mentorship), Collaborate with other organizations (PR), launch our social impact project (Non-profit) and of course, finance. This holistic experience allowed me to get a well-rounded view, or let me say, a trailer of how organizations are built but most importantly sustained. The leadership experience and the exposure I got by interacting with more than 1000 leaders, students, and industry professionals built my network and allowed me to gain a much larger perspective of the corporate world. In my corporate interviews, FinOak has hands down been the most talked about part of my experience and indeed the most impressive.

Internships

Experience at Urban Company:

During my first year, I got the opportunity to work remotely with Urban Company. Even though the role I was hired for was very limited (since I was a first-year and did not have much experience), I made sure that I assumed more responsibility and slowly got more involved in the project. I was working on a pilot project where UC had to test the product market for product demand in certain categories (Electricity, Plumbing and Carpentry). Though my role started with cold-calling customers, I constantly asked for more responsibilities while fulfilling the current ones to the best of my capabilities. I started showing up to team meetings with higher management, vendor briefings, giving my ideas in the brainstorming sessions and so on. Slowly, I went on to lead a team of interns as I drove the project. Had I not built the opportunities for myself, I would not have completed half the work I did in Urban Company. My experience at Urban Company and my understanding of the project were other things that interviewers got impressed by.

Experience at Hindustan Unilever:

Close to the internship season, my profile was very finance oriented. When HUL came to recruit, it offered three roles: Sales and Marketing, HR and Finance. While Sales and Marketing was the most competitive (and interested me the most since Marketing is the heart of HUL), Finance was the safest bet for my profile, a suggestion I got consistently from my mentors as I was filling the application. I had to choose my domain, but the choice wasn’t that simple; I had realized that I do not want to pursue finance anymore and wanted to explore marketing. Risking my chances of selection, I chose marketing and luckily got through. I was recruited on campus for the summer internship. To give some context, HUL recruits summer interns under their Unilever Leadership Internship Program from certain colleges in India. The recruitment was a 4 stage process with Application Shortlisting, Hire-vue round, Group Discussion and Personal Interview. Some tips that helped me during the selection process were:

Using the application form as an opportunity to be as detailed and expressive as possible. It shows effort and consideration.

Intense research on the company and its brands and reading marketing case studies helped me prepare for my hire-vue round where any situation/case-based question could be asked.

Approached the GD with a lot of patience and calm, didn’t try to be the loudest, but rather tried to moderate the discussion and work with others, not against them to reach the conclusion.

Maintained an extensive google doc where I answered personal questions. Had gone through my CV to not just answer the ‘What?’ of my work but also, ‘Why?’. Went deep into each project and experience and understood the business logic, and customer side of it.

My internship was based out of Mumbai. I worked on 4 Projects that mostly revolved around brand building (Influencer marketing, social media marketing, YouTube series launch, and Online Response Management). My experience marketing FinOak sure helped me navigate through my projects with my manager’s guidance. I used this opportunity to make sure I not only do my work well but also learn from senior leaders and what they do at HUL. As college students, while we might be fascinated by a certain career, we don’t understand what work goes into it, or what actually is done on the job. Hence, talking to managers at HUL helped me learn about what work managers do and their journeys before and at HUL. After excelling at my projects, I was recommended for the PPI and later received a PPO.

I do not feel that any marketing experience was needed to excel at the internship. Most of my co-interns did not have marketing experience but worked very well. Like me, they did not have marketing oriented profiles either.

Key Takeaways for students looking for internships:

LinkedIn is the best platform to look for internships (especially for students from campuses that don’t have a lot of companies recruiting during internship season) and in my experience more effective in terms of response rate than cold mailing. Keep your profile updated, connect with people in your targeted industry, build a relationship with them and be considerate as you ask for an internship. Always customize your message and leave a great first impression. Reach out to your college/school alumni, they’d be more willing to help you than someone you don’t have any commonality with. Instead of only targeting HRs (which a lot of students do), target team leaders, and project managers to ask for available positions in their team.

Stop chasing brands in your first internships. Be open to any learning opportunity that sounds exciting. As a first year, it could be difficult to find good roles, but once you have a foot in the company, work hard to expand your role by taking initiative and showing interest.

Doing a few quality internships is better than doing many internships.

If you are struggling to find a corporate internship, stay engaged with student communities, organizations and NGOs. Most of them do not require a heavy time commitment but do offer considerable learning experience and networking opportunities.

I highly recommend students be a part of a student community in a field they wish to pursue a career. It amplifies your show of passion towards the field in your CV.

Bain & Co.’s True North Scholarship

True North Scholarship is a program for exceptional female students to support and encourage them to enter a field where women are underrepresented. It was open to students from select colleges, and my college was one of them. The selection process included an online aptitude and personality test, a Case round and a Final Interview. I prepared for the process by practising frameworks from casebooks (Case Compendium by SRCC, IFSA St. Stephen’s Casebooks) and YouTube channels (Victor Cheng, Aaditya Agarwal). I was writing my second-year final exams when the process took place, hence, I found myself to be a bit more underprepared than I’d like to be. However, what made me get through the process was my focus on the approach and not the answer, being a quick thinker and comfortably changing approaches without panicking, being calm as I was grilled in interview rounds and being myself; told what I know very well, confessed what I didn’t and stuck to my values in the personality round. I was honest about my goals and didn’t try to give the perfect answers that I felt the company would want to hear (on questions about my long-term goals, interest in consulting, and views on the company). I was delighted to be one of the 16 women from India to receive the scholarship. I received a Bain Mentor, a scholarship amount, and a PPI. However, I did not pursue consulting because I had developed an interest in marketing.

College Societies:

I had joined only two societies since the beginning: Finance and Investment Cell and IFSA, and I ended up becoming the Vice President and President of them respectively. For me, joining college societies was about finding like-minded people and hopefully friends. Being from the online batch of joiners, I did not have a lot of avenues to interact with my peers, so societies became that avenue. In terms of learning, while initially, societies offer a good learning experience, the work after a point becomes repetitive and the learning curve flattens. Especially for me, at the Finance and Investment Cell, there was no real learning because of my vast experience at FinOak. Hence, I strongly recommend students join one society that is considered ‘good’ at their college, and one society that offers rich learning/passion. Do not overburden yourself with societies, because it becomes especially difficult in the second year when the academic burden rises and you plan to do internships. Even if you fail to get into your desired college societies, you can look for PORs outside college at student organizations, and NGOs (Some of my own PORs are from off-campus organizations and communities).

Key takeaway:

Societies are crucial for finding your place and purpose in college. Target societies carefully; one that others value (the top societies) and one that you value (that might not be the ‘best’ but you feel passionate towards). Do not burden yourself with society and make sure to leave enough time for your own learning and internships; plan your involvement and time commitment to societies wisely. Even if you do not get to be a part of societies (hence are worried about not having enough PORs), look for off-campus opportunities at student organizations, NGOs, etc.

Academics:

Maintaining a good GPA is always safer. But what is “good” might differ from college to college and course to course. It is safe to say that you should at least aim for a GPA of more than the average GPA of your course at all times. The reason is that a lot of companies when hiring for full-time roles/internships have a GPA requirement, below which, no matter how excellent your ECAs/ PORs are, they would not shortlist you. Does that mean you should be extremely focused on academics and try to top your course? Not really. After you qualify for those minimum standards, how high your GPA is rarely matters. It is then that your candidature is defined more by other sections of your CV.

Skill Building:

While most of my skills were built through experiences and not courses, I feel the following few courses really benefited me.

Finance: I did NCFM’s Equity Trading and Options Trading certifications. NCFM is a paid certification offered by NSE. It has several modules and candidates can choose based on their interests. You are issued a certificate when you pass the offline exam. I highly recommend first and second years interested in finance to undertake NCFM (and NISM offered by SEBI), especially if they want to pursue FRM/CFA. It helps you gauge your interest in finance and gives you a teaser of the heavier courses that lie ahead. For me, NCFM made me realize that I am not enjoying finance, even though I am excelling at it. The realization came at the right time, right before the deadline to register for FRM (which was my aim at that time) and saved me from paying the hefty fee. In my interviews with finance companies (on-campus internship interview with an IB firm), the knowledge I gained through these certifications gave me an edge over other candidates. Interviews definitely noticed and valued this.

Besides NCFM, I did free courses on EdX and Coursera. I also learned Advanced Excel and studied valuation from Prof. Aswath Damodaran’s Youtube playlist.

Marketing: For marketing, I have relied on books more than courses. I read brand case studies and ad campaigns. I did a free certification on digital marketing from Google Garage and Fundamentals of Sales and Marketing by Goldman Sachs. These certifications didn’t really help directly in my selection process for a marketing role (on-campus internship that I converted) but it was good to do them regardless.

Consulting: I did a lot of case study competitions in my first and second years. It helped me develop a knack for problem-solving and understanding business problems. I also learnt the art of presenting which I feel has taught me storytelling; the most powerful skill to have.

Students often ask me if they should do a paid course and mention the course certificate in their CVs. In my opinion, unless the course certificate is provided by a credible body after some sort of examination/assessment, a completion certificate is of no use and I do not advise students to put it in their CV. I also recommend students find free alternatives to paid courses from YouTube, where almost everything is available. Skills acquired from the course are important, not certificates.

That was my journey and I tried to cover as much as I could. I would like to leave you with the following key lessons:

Do not run after an ‘ideal’ profile, because there isn’t any.

Do not be afraid to do the unconventional. Do not follow other people’s ‘formula for success’. There is no one way, one career or one skill that will make you incredibly successful.

Ask for more. Take initiative. Show commitment. That is what distinguishes an employee from a potential leader.

Seek mentorship. Avoid mistakes that other people have made, and learn from their journey.

Appreciate diversity. Be around people who are different from you and learn from them. Learn to step out of only enjoying the company of like-minded people or friends.

It is okay to go with the flow, as long as it doesn’t mean stagnancy. You don’t always need to run to pursue set goals and targets. Your goals will and should change as you evolve as a person. Accept change and embrace hard work, things will happen to you.

Focus on doing more at a few opportunities than a few at more opportunities. Do not stretch yourself too thin by taking up too much on your plate.

Being consistent is more important than being perfect. Keep trying, even the things that you're underconfident about. You never know what will work out for you.

If you wish to learn more about my journey, feel free to reach out to me on LinkedIn, happy to help! All the best for your college life and beyond :)

This will be it for this week, see you next Friday. Best RegardsTeam FinOak