- The FinOak

- Posts

- Buy shares at a discount and earn higher yield!

Buy shares at a discount and earn higher yield!

Buy shares at a discount and earn a higher yield!

Hello, FinOak readers,We hope that this newsletter finds you in the right spirit! In our weekly wrap up column, we have covered about the controversial Adani-Hindenburg case, followed by budget highlights and a funny yet serious incident of a marketing blunder by a Chinese Porsche dealer.In Personal Finance column, we have another exciting investment alternative, shares at a discount, that can be a perfect choice for retail investors!

Column 1

Weekly Wrap Up

In today’s Edition

How an American research firm led to a dramatic fall in Adani’s wealth within 7 days

Budget 2023 highlights

Porsche Model available at 90.6% discount, book yours now!

1.

How an American research firm led to a dramatic fall in Adani’s wealth within 7 days

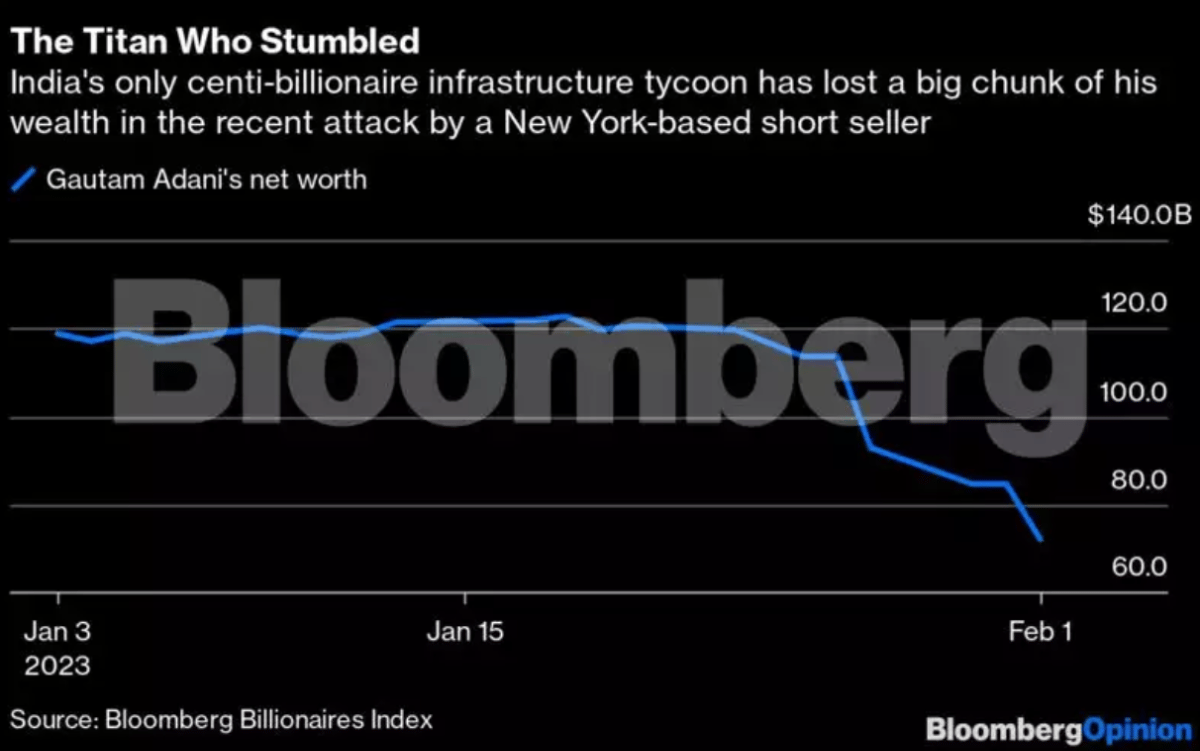

It all started when an American Research Firm, Hindenburg Research published a report on 24th Jan 2023 stating that Adani Group (at that point had a market value of over $200 billion), owned by then India’s Richest Man, Mr. Gautam Adani was involved in a brazen stock manipulation and accounting fraud scheme over the course of decades.

This report was published just days before Adani Group was about to go forward with the country's largest Follow on Public Offering (FPO) of Rs. 20,000 Crore. The Group termed this report as a “calculated attack on India” and its institutions at the time when India is on the path of economic prosperity. However, this cannot hide the fact that Adani Group saw a drastic fall in the market capitalization value and Mr. Gautam Adani saw his wealth being slumped down by $20.3 billion to $92.7 billion on 27th January 2023.

With several national banks like SBI, Punjab National Bank, Bank of Baroda and India’s state owned insurance group, LIC being exposed to this due to their cash infusion in various firms under Adani Group, there were many talks in the town in last few days that what will happen to the cash of general public who invested their savings in these banks? This situation will be clear only when this dramatic saga unfolds further in the coming days.

With about $100 billion being eroded from the market capitalization value of Adani Group with Adani Enterprises, Adani Total Gas being severely hit, the road ahead is definitely not easy for Gautam Adani and his group. Adani Enterprises was removed from the Jones Sustainability Indices by S&P Dow Jones. To curb speculations, NSE on Thursday said three Adani group stocks namely Adani Enterprises, Adani Ports and Ambuja Cements will require 100 per cent margin to trade in their shares. Citigroup Inc’s wealth arm stopped accepting Adani Group securities as collateral for margin loans. The US lender’s move follows a similar decision by Credit Suisse Group. The private banking arm of Credit Suisse AG has stopped accepting bonds of some of the group entities of Adani Group -- Adani Ports & SEZ, Adani Green Energy and Adani Electricity Mumbai – as collateral for margin loans.

2.

Muse Of Today's News: UNION BUDGET 2023

Couldn’t hear the budget because your college has an attendance issue?

Well, don’t worry, we’ll give you the most crucial aspects and our analysis of what happened at 11 A.M. on 1st February (Did you know that this news is more viral than Aishwarya Rai’s 1994 Miss World Tour video in India?!)

Firstly let’s talk about the most relevant aspects of the Budget, The Economic Times suggests that the primary interest of the Budget, 'Saptarishi’ is to focus on the following industries/segments:

Inclusive development

Reaching the last mile

Infrastructure and Investment

Realising the true potential of India

Green Growth

Youth Power

Financial Sector

We have accumulated the most relevant information out of the budget for you! (We promise that this will definitely be more helpful in conversations in your life than what you learned in college today!):

Hello, Income Tax Payers:

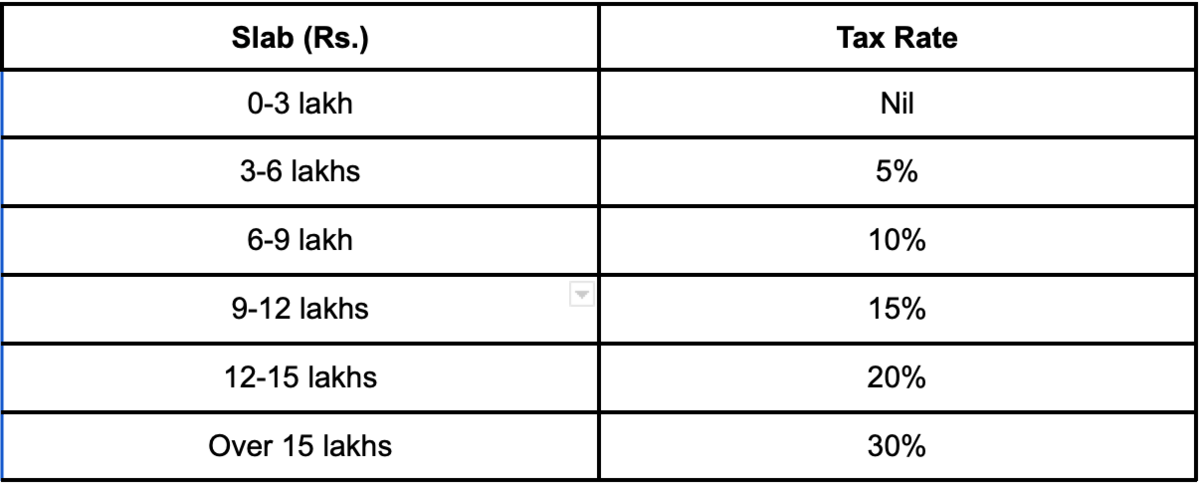

There will be no changes in the old tax regime, new tax regime to become the

default tax regime. However, citizens can opt for the old tax regime. There will be no tax on income up to Rs 7 lakh a year in the new tax regime (with the inclusion of standard deduction). The Government is aiming to reduce the highest surcharge rate (surcharge is an additional charge or tax) from 37% to 25%.

New Income Tax Slabs Under New Tax Regimes:

An individual with an annual income of Rs 9 lakh will have to pay only Rs 45,000 in taxes. FM Sitharaman said that an income of Rs 15 lakh will fetch Rs 1.5 lakh tax, down from Rs 1.87 lakh. There will also be a Rs 50,000 standard deduction for taxpayers. Tax exemption is also removed from insurance policies with a premium over Rs 5 lakh.

For online games, govt proposes to provide for TDS and taxability on net winnings at the time of withdrawal or at the end of the fiscal Tax exemption on leave encashment on the retirement of non-government salaried employees hiked to Rs 25 lakh from Rs 3 lakh.

A higher limit of Rs 3 crore for TDS on cash withdrawal is to be provided to cooperative societies. A higher limit of Rs 3 crore for TDS on cash withdrawal is to be provided to cooperative societies. Not only this but the next-generation Common IT Return Form is to be rolled out for taxpayer convenience. TDS rate to be reduced from 30 percent to 20 percent on the taxable portion of EPF withdrawal in non-PAN cases.

What gets cheaper and what gets costlier:

Cheaper:

Mobile phones

TV

Lab-grown diamonds

Shrimp feed

Machinery for lithium-ion batteries

Raw materials for the EV industry

Costlier:

Cigarettes

Silver

Compounded rubber

Imitation Jewellery

Articles made from gold bars

Imported bicycles and toys

Imported kitchen electric chimney

Imported luxury cars and EVs

Savings Scheme Initiatives:

The Maximum deposit limit for Senior Citizen Savings Scheme has now enhanced to Rs 30 lakh from Rs 15 lakh. The Monthly Income Scheme limit doubled to Rs 9 lakh and Rs 15 lakh for joint accounts.Not only this but a One-time new saving scheme was launched, called Mahila Samman Saving Certificate. This certificate is to be made available for 2 years up to March 2025. It will offer a deposit facility of up to Rs 2 lakh in the name of women or girls for the tenure of 2 years at a fixed interest rate of 7.5 percent with a partial withdrawal option.

Revamping MSME:

The Finance Ministry revamped the credit guarantee for MSMEs to take effect from April 1, 2023, with an infusion of Rs 9,000 crore in the corpus. This scheme would enable additional collateral-free guaranteed credit of Rs 2 lakh crore and also reduce the cost of the credit by about 1 percent.

Employment Creation:

The Government will launch Pradhan Mantri Kaushal Vikas Yoiana 4.0 to skill the youth for international opportunities. 30 Skill India International Centres will be set up across different States. There will be a Direct Benefit Transfer under a pan-India National Apprenticeship Promotion Scheme to be rolled out to provide stipend support to 47 lakh youth in three years.

Digital Service Advancements:

Scope of services in DigiLocker to be expanded. Upto 100 labs for developing applications to use 5G services to be set up in engineering institutions. Labs will cover smart classrooms, precision farming, and healthcare applications.Phase 3 of E-courts projects are to be launched with an outlay of Rs 7,000 crore. In fact, leading industry players will partner to develop scalable options for health, agriculture, and other sectors.

In hindsight;

For all the quick takeaway readers, here is a short list of brief aims of Budget 2023:

Facilitating plenty of opportunities for citizens (especially youth).

Providing strong support to growth along with sustainable job creation.

Strengthening of macroeconomic stability

Aim towards empowering women.

To enable women's self-help groups (SHGs) to reach the next level by providing material supply, branding, and marketing of products.

Want to read more in detail? Tap here

3.

Porsche Model available at 90.6% discount, book yours now!

False thumbnail or Dealership blunder?

The Porsche Panamera has a starting price of Rs 1.5 crore (ex-showroom) and goes up to Rs 2.7 crore (ex-showroom) in India and competes against cars like Mercedes-AMG GT63 S 4-door Coupe. Due to a mistake made by a Chinese dealership, the world's leading luxury sports car manufacturer was placed in a very awkward situation in China. A 2023 Porsche Panamera model listed by the Chinese vendor in error at $ 18,000 (over Rs 14 lakh) was actually worth $ 148,000 (or roughly Rs. 1.21 crore) .

The trouble scenario reveal of the ‘once in lifetime deal’:-

The popular 2023 Panamera model was advertised online by the Porsche dealer in Yinchuan, a city in northern China, for 124,000 yuan ($18,000), or one-eighth of the sedan's actual starting price. People eager to purchase a car quickly noticed the advertisement and hurried to the dealer for what they believed to be a great price.

Porsche disclosed that there was "a fundamental mistake in the quoted sale price" after hundreds of prospective purchasers made their reservations and paid 911 yuan in advance. The German firm had already removed the web advertisement by that point. But what actually happened was that the automaker was ridiculed on the Chinese social media site Weibo.

Porsche briefed customers who reserved the 2023 Panamera on the issue and made a commitment to return the money within 48 hours of the cancellation of the reservations. However, the dealership's error benefitted the first customer who booked the reservation. According to reports, they "negotiated an agreeable solution" for one stock vehicle :)We will definitely try to reach out to this man/woman for some Bargaining classes 101!

Meanwhile, China Advertising Law to Porsche- Knock Knock?

Column 2

In today’s Edition

Unlocking the Potential of DVR Shares: A High-Yield Investment Option in India

1.

Unlocking the Potential of DVR Shares: A High-Yield Investment Option in India

DVR Shares, or Differential Voting Rights Shares, are a type of equity stock that has become increasingly popular in India over the past few years. These shares offer a different set of rights and benefits compared to ordinary shares, making them an attractive option for certain types of investors.

DVR shares give shareholders a higher dividend payout compared to ordinary shares, as well as greater liquidity. However, they come with fewer voting rights. While an ordinary share gives the shareholder one vote per share, a DVR share may give the shareholder only one vote per several shares. This means that while DVR shareholders have a stake in the company, they have less say in the decision-making process.

DVR shares were first introduced in India by Tata Motors in 2007, and since then several other companies have followed suit. They are listed on major stock exchanges, such as the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), and can be bought and sold like any other equity stock.

Investors can find DVR shares through a brokerage firm or a financial advisor, and it is important for them to carefully consider their investment goals and risk tolerance before making any investment decisions. DVR shares may be ideal for individuals who are looking for a higher dividend payout but do not wish to be actively involved in company decision-making. On the other hand, ordinary shares may be more suitable for investors who wish to have a say in company decision-making and are willing to forgo a higher dividend payout for that privilege.

In addition to the differential voting rights and higher dividend payouts, DVR shares also have other advantages. For instance, they offer greater liquidity compared to ordinary shares, making it easier for investors to sell their shares quickly in the market if needed. This is particularly attractive for short-term investors, or those looking to sell their shares quickly in case of a market downturn.

Another advantage of DVR shares is that they can provide a more stable source of income for investors. Because the dividend payouts are higher, DVR shares can be an attractive option for investors looking for a steady source of passive income.

In conclusion, DVR shares are a unique investment opportunity for investors in India, offering higher dividend payouts, greater liquidity, and a more stable source of income compared to ordinary shares. However, it is important for investors to consider the trade-off of having fewer voting rights in company decision-making. Before investing in DVR shares, it is recommended to seek advice from a financial advisor and carefully consider your investment goals and risk tolerance.

This will be it for this week, see you next week. Best RegardsTeam FinOak