- The FinOak

- Posts

- From Great Power to Misused Authority: The Chanda Kochhar Story

From Great Power to Misused Authority: The Chanda Kochhar Story

From Great Power to Misused Authority: The Chanda Kochhar Story

Hello, FinOak readers! 2022 is about to end and we hope this year has been good and the next one will be even better, since this will be the last newsletter for this year we have some interesting topics for you to have a read.In the weekly wrap up, we have covered the stories of two influential women and another investment by Reliance Strategic Business Ventures Ltd. For the personal finance column this time we have tried to cover the most in-demand topic of how to find stocks for good dividend yields.For our Featuring Future Leaders column, we have covered Smriti Ramesh, a third year student at Lady Shri Ram and incoming analytics representative at Bloomberg LP. Smriti, who has worked at Hindustan Unilever and Finshots as a finance intern, shares how she was able to bag her placement at Bloomberg LP, a global media and financial data and analytics conglomerate. She in detail talks about her college journey and everything she did to accomplish her goals, spilling everything, from learnings to tips that she has realised over 3 years of pursuing finance. So stay tuned till the end!

Column 1

Weekly Wrap Up

In today’s Edition

Chanda Kochhar Case

Reliance bought a 23.3% stake in Exyn Tech for $25M

Manasi Tata to continue the legacy of the Kirloskar group

1. Chanda Kochhar Case

“And the Retail Banker of the year 2004(Asia Pacific) goes to……. Ms. Chanda Kochher.”

“Chanda Kochhar has been ranked by Forbes 20th position in "100 most powerful women in the world list’ 2009.”

“Today’s headline Chanda Kochhar, MD and CEO, ICICI bank has been selected for Padma Bhushan Award 2011."

“We are glad to announce that Kochhar was ranked as the most powerful businesswoman in India in Forbes' list of 'The World's 100 Most Powerful Women 2013“

Fast Forward to 24 December 2022

“Breaking News, Former MD and CEO of ICICI Bank Limited Chanda Kochhar and her husband Deepak Kochhar have been taken into 3 days CBI remand in ICICI- Videocon Rs 3250 crore scam.”

Chanda Kochhar is not an unfamiliar face in the business world, you might have guessed this by looking at the glimpse of her past achievements. The face of women empowerment in the banking sector who in her 34 year of professional journey took ICICI from nothing to where it is today.

Starting her journey as management trainee at ICICI in 1984 Chanda made her own way up to the top. All the way from being a core team member for setting up the bank, to being its executive director, then the deputy MD, then CFO and then finally to becoming MD and CEO in 2009.

Rising up to power gives a person 2 things -

1. Great responsibility 2. Temptation to misuse power

Well the ICICI-Videocon Case revolves around these two things as in Chanda failed in her responsibility to disclose possible conflict of interest in giving loan to videocon and using her power to sanction loans for videocon.

You must be feeling a bit confused as to what really happened, Let’s understand it in detail:

The case

It is alleged that credit facilities of around Rs 3,250 crore were sanctioned to Videocon group companies while Kochhar was the CEO, but that sanctioning of such a lump sum amount was a violation of RBI rules and the ICICI Bank’s credit policy.

CBI has alleged that six loans were disbursed by ICICI Bank to Videocon Group and its associated firms between 2009 and 2011 during Kochhar’s tenure.These loans were:

Loan of Rs 175 crore was sanctioned to Millennium Appliances India Ltd – a Videocon Group company.

Videocon International Electronics Ltd received a Rs 300 crore loan.

Rs 240 crore was sanctioned to Sky Appliances Ltd.

Rs 110 crore was sanctioned to Techno Electronics Ltd.

Rs 300 crore loan was sanctioned to Applicomp India Ltd.

Rs 750 crore loan was sanctioned to Videocon Industries.

She was a part of the committees that sanctioned the two major loans, worth Rs 300 crore and Rs 750 crore. The matter further got complicated as the CBI alleged that the Videocon group transferred a part of the sanctioned loans to Deepak Kocchar’s company.

As per CBI's allegations, Videocon’s Dhoot had invested Rs 64 crore in Deepak Kochhar’s Nupower Renewables and allegedly made this investment through a company Supreme Energy Pvt Ltd (SEPL), which he transferred to Deepak Kochhar-managed Pinnacle Energy Trust. The transfers happened from 2010 to 2012. As per the CBI's information, the transfer of Rs 64 crore to Nupower happened a day after the loan worth Rs 300 crore was disbursed in September 2009 and was alleged the quid pro quo..

While probing the case, ED also found that the loans sanctioned to the Videocon group were kept alive by ever greening or refinancing of loans worth around Rs 1,730 crore, which turned into bad loans for ICICI Bank in June 2017.

Recent developments

Three days after arresting Chanda and deepak kochhar, CBI has now arrested Videocon’s Venugopal Dhoot in fraud case and the Kochhar couple has filed a case against CBI for illegal arrest in HC though the bombay high court has rejected their request for urgent hearing.

2. Reliance Industry acquires 23% stake in US-based AI and Robotics startup Exyn.

On December 22, Reliance Industry's wholly owned subsidiary Reliance Strategic Business Ventures Limited paid $25 million for a 23.3 percent share in Exyn Technologies Inc, a Philadelphia-based company.

The Indian firm's investment is part of a larger $35 million Series B fundraising round for the Philadelphia startup, which provides robotic autonomy in complicated, GPS denied environments.

According to RIL regulatory filing, the investment and partnership by RSBVL will have synergies with Reliance’s investment and strategic initiative in drones, industrial safety and security, and robotics, while accelerating Exyn's product and technology development across several application areas and commercialization.

Exyn is an early stage and leading autonomous technology business that was founded in Delaware in 2014 and has its headquarters in Philadelphia, Pennsylvania. It specialises in allowing drones and robots to travel tough terrains without the need of GPS or other navigation technology. The company's full-stack solution allows for the flexible deployment of single or multi-robots capable of intelligently navigating and dynamically adapting to complicated environments in real time.Furthermore, Reliance reported that Exyn's revenue for fiscal years 2021, 2020, and 2019 was $4.32 million, $1.83 million, and $0.16 million, respectively.

In our last issue, we stated that Reliance had agreed to buy Metro AG's India subsidiary for $344 million. Metro entered India in 2003 and after about 19 years of business with over 31 outlets throughout the country, it was sold to Reliance for Rs 2850 crores in cash.

3. Manasi Tata to continue the legacy of The Kirloskar Group

Kirloskar Systems (KSPL) on Monday announced the appointment of Manasi Tata as director on the board of KSPL’s Joint Ventures companies, including Toyota Textile Machinery Pvt Ltd, Kirloskar Toyota Textile Machinery Pvt Ltd, Toyota Material Handling India Pvt Ltd, and Denso Kirloskar Industries Pvt Ltd.

This step comes after her father Vikram Kirloskar’s ( Former Chairman and MD) untimely death on November 29, 2022.

Vikram Kirloskar was the fourth generation scion of the Kirloskar business family, Vikram Kirloskar is remembered as a pioneer of India’s automotive industry. The credit for bringing Toyota’s business to India goes largely to him. Toyota Motor Corporation entered India in 1997 in a joint venture with the Kirloskar Group. Toyota Motor Corporation (TMC) holds 89% of the share and the remaining 11% is owned by the Kirloskar Group.

Manasi Kirloskar is the only child of Vikram Kirloskar and the daughter-in-law of Neville Tata (son of Ratan Tata’s half-brother). She is a graduate of the Rhode Island School of Design in the US and is trained in Toyota manufacturing processes and Japanese work culture.

The Kirloskar Group is an Indian conglomerate, headquartered in Pune. The group exports to over 70 countries over most of Africa, Southeast Asia, and Europe. It was one of the earliest industrial groups in the engineering industry in India. The company under Shantanurao Laxmanrao Kirloskar achieved one of the highest growth rates in Indian history, with 32,401% growth of assets from 1950 to 1991.

Column 2

In today’s Edition

How to Pick the Best Dividend yield Stocks

1. How to Pick the Best Dividend yield Stocks

Dividends may be an effective method for people in their twenties to obtain a steady income through stock investments. When compared to other growth stocks, a solid high-dividend stock can help you fight inflation and has a smaller probability of losing value in a rapid market crash. A stock with a high dividend yield may be an excellent addition to any investor's portfolio.A dividend is a distribution of earnings by a corporation to its loyal shareholders that is determined by the board of directors of the firm. These firms often have a strong foothold and a significant presence in the sector. Dividends are given at predetermined intervals, such as monthly, quarterly, or yearly.In this piece, we'll look at how to pick high-dividend-yielding stocks. But first, we must define what a dividend yield stock is.A dividend yield is a financial ratio that illustrates how much a firm pays out in dividends each year in relation to the price of its shares.The formula is simple:Dividend Yield = Annual Dividend ×100 / Share Price

This is an essential ratio because it allows investors to evaluate firms based on their capacity to pay dividends. There is no set standard for defining a stock as a high dividend-yielding investment.

Let us now look at how to find high dividend-yielding stocks.

1) Examine the Dividend Yield

It is a popular method of determining if the firm is paying out dividends as expected and whether the dividend-to-capital-growth ratio is adequate. A perfect stock will have a dividend yield that has been steadily increasing over time.

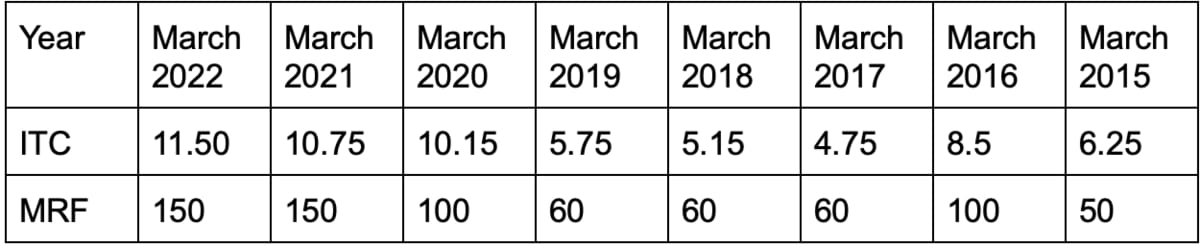

Let’s take an example of ITC and MRF. As per people in the market ITC is a high paying dividend stock whereas MRF don’t give dividend much. This perception can be validated from their financials as well.

For the year ending March 2022 ITC has declared an equity dividend of 1150.00% amounting to Rs 11.5 per share. At the current share price of Rs 334.40 this results in a dividend yield of 3.44%.

Now look at MRF,

For the year ending March 2022 MRF has declared an equity dividend of 1500.00% amounting to Rs 150 per share. At the current share price of Rs 87923.25 this results in a dividend yield of 0.17%.

Well on absolute basis MRF has provided more dividend to investor but if we see dividend yield, we can say that investor’s income relative to share price is better for ITC than MRF.

2) Avoid high-debt firms

Investors should avoid dividend-paying corporations with excessive debt since it will harm the company in the long run. Before investing in a stock, look at the debt-to-equity ratio. High debt firms first priority in paying interest on their loan. This reduces the amount of profit left for shareholders. So if you are looking for dividend income then avoid these type of firms.

3) Consider Dividend Growth

Investing in a dividend stock entails more than just receiving the same amount of dividends year after year. The dividend distribution should also increase. A minimum five-year track record of good dividend distributions indicates that dividend growth will continue.

Again let’s bring ITC and MRF

Both the companies has shown stellar increase in dividend in last 6 years. This shows management's inclination towards increasing shareholder’s income. And good sign on companies profitability.

4) Review Industry Trends

Market trends provide information on industry trends in many sectors. Investors should focus their investments on industries with promising long-term development potential. This lays the door for future dividend increases to be consistent. A sector that is expected to perform well in the future might be an excellent sector to pick a dividend-paying company stock from.

5) Long-term profitability

Dividends are profit distributions made by companies to their shareholders. As a result, it is essential to find companies that are likely to generate excellent long-term earnings. In a perfect scenario, you would make long-term investments in equities that continuously provide dividends.

6) Evaluate the EPS of the company

Examine the earnings per share (EPS). It provides insight into the company's profitability in relation to its shareholders. A firm with a high and constantly increasing dividend yield ratio and a consistently expanding EPS is typically seen as a solid investment.

7) Check Price to earnings ratio (P/E Ratio)

Lastly, investors should consider the company's Price to Earnings (P/E) ratio. This might assist investors in determining if the present market price of the company's shares is overpriced or undervalued. As a result, they will be in a better position to assess the stock's dividend yield.

Finally, while investing in high dividend yield stocks is considered safe, it should not be taken lightly. Investors must check that the firm is worth investing in and avoid purchasing stocks just for the dividend yield.

Column 3

Featuring Future Leaders: Smriti Ramesh

Hey guys, this is Smriti Ramesh, and today I’m going to walk you through my journey into the world of Finance that eventually led me to a role at Bloomberg LP.

But before that, here’s a brief background: I’m presently a third-year B. Com Honours student at LSR. I’m from Bangalore, so Delhi was a whole other world to me. This, coupled with everything new that college brought to the table (be it societies, CV Building, internships, etc), made it seem like the world as I knew it was changing. Due to this, I initially decided to take it slow and stick with my comfort zone, something that felt like a constant in this sea of variables. And for me, that comfort zone was writing.

Profile Building: College Societies, Skills Building, Experience at Finshots

During my first year, I only joined literary societies. Writing always appealed to me right from my school days, but I never really put my work out there for everyone to see. So, in college, I did just that. I became a part of the College Magazine, the creative writing society, my department content team, and the Literary and Reporting division of the Equal Opportunity Cell. Since I spent a year writing, I could build a strong profile geared toward Content Writing. I eventually used this strength, this comfort zone of writing to pivot to areas I was not as comfortable with (but more on that later). In my second year, I felt settled into the rhythm of college, so I became a lot more strategic in my approach and began gearing my profile toward the field I was interested in. And for me, that field was finance. I joined the Finance and Investment Cell of my college. I also joined the Placement Cell to hone my communication skills and learn networking. Apart from this, I did a couple of skill enhancement courses on Advanced Excel, Power BI, Tableau, and Financial Modelling on Udemy. I also began reading books on Finance (‘Rich Dad, Poor Dad’ and ‘The Warren Buffet Way’ are personal favourites. I still stuck with writing, only this time it was in the form of an internship instead of society work. And that brings me to Finshots.

For the uninitiated, Finshots is an organization that simplifies the latest Business, Economics, and Finance news. As someone who was a fan of their work for the longest time, I was very keen on joining the team that works behind the scenes to make the magic happen. I initially waited around for an opening in their content team. They did eventually have one, but it was for graphic designing. I decided to shoot my shot anyway and wrote them a cold email mimicking their writing style and pitching myself as a Business Writer. In the email, I walked them through everything: how I was scared of Finance for the longest time, how a friend introduced me to Finshots, how I enjoyed reading their breakdown of some of the most complicated concepts, how I eventually overcame my fear of Finance with the help of this page, and how I’d love to create impact as part of their team since I myself was a beneficiary of their work. I also attached a work sample (which was also in their writing style:) I heard back the very same day. After a couple of subsequent rounds, I got the internship. At the internship, I initially started as a writer for Finshots but I was eager to pitch ideas for Ditto (their Zerodha-backed insurance advisory firm) as well, so I soon became a writer for both. I was also interested in taking up work beyond the purview of writing and was given numerous opportunities to try my hand at multiple things, including a bit of influencer marketing.

Something I learned here about the dynamic world of start-ups is that initiative goes a long way. Start-ups love giving you opportunities to learn and grow, provided you exhibit enthusiasm and the right attitude! A lot of us want big brands on our CVs from the get-go, but to be honest, start-ups are one of the best places to start at. They’re more accessible to college students, (slightly) easier to get into, and the learning curve is immaculate.

Key Takeaways:

1. Cold emails with a personal narrative that strike a chord with the reader have a higher chance of receiving a response.

2. If you truly want to make the most out of an experience, go that extra mile. Involve yourself in activities that excite you and keep expanding your role at the organisation.

3. When compared to big firms, start-ups provide excellent growth opportunities if you have the right attitude and are (slightly) easier to get into.

Summer Internship at Hindustan Unilever

Although I was writing about Finance, I didn’t quite have experience in the field. I wanted to know if it was the right fit for me, so the natural next step was to get an internship there. Fortunately, during the second year, Hindustan Unilever came on-campus recruiting for ULIP, their flagship summer internship program. They came to hire for three functions: HR, Marketing, and Finance. I decided to go with Finance. Now, one thing about HUL is that they don’t take CVs right off the bat. Instead, there’s an elaborate application form asking for information about you, your grades, internships, positions of responsibility, extracurriculars, etc. Although this is pretty much the same standard information you find in a CV, the difference here is that it’s in the form of a google form. This means you no longer have to conform to a one-page CV to fit in everything you want the recruiter to know, ergo a huge advantage. Tell you why. I’ve come to learn that it’s not the experience you have that counts, but how you present that experience. I didn’t have any direct experience in Finance. But having that window to express myself meant that I could speak about how I was interested in the field and how I spent 4 months writing about new financial developments happening in the world. I spoke about how I was eager to work with the organizations that are behind the developments I spent the last couple of months writing about. That exhibited a clear interest in the field, and that helped me eventually land a shortlist. An important thing that I think many of us forget is that when recruiters come to hire undergraduate students, they aren’t looking for a lot of professional experience. They know we’re just starting out. Instead, what they try to gauge is your interest, your enthusiasm, and your willingness to learn. As long as your narrative exhibits that, you should be good to go. The same applies even when organizations ask for your CV directly in round 1. Make sure you tweak your CV to cater to that role before going ahead and applying. The right keywords and narrative can truly boost your chances of clearing the round.

There were three other stages in the HUL process: a Hirevue (video interview), a Group Discussion, and a Personal Interview. What helped me clear each round was: thorough research about the company and the role, a strong reason for why this role and field, a sound understanding of common finance terms and concepts (Investopedia and Wallstreetmojo are incredible resources), a good grip over the business and financial developments (Planet Money, The Signal Daily, The Journal, Exchanges at Goldman Sachs, and the Finshots Podcasts are helpful in this regard), and clear articulation. Interviews, in particular, are all about authenticity and marketing yourself in the moment. Confidence is key!

I bagged the internship at HUL and spent two months working in their Source to Pay team, handling vendor payments for Unilever. I worked on four projects centred around enhancing their Payments on Time (key KPI) figure. I had a wonderful learning experience, but over the two months, I learned that while finance is the right fit for me, corporate finance is not. I was more inclined toward the financial markets side of things. This experience is a strong reason why I constantly encourage people to try out different fields before niching down. You’ll never know what truly speaks to you unless you give different experiences a fair shot.

My first job at Bloomberg LP

At the end of my summer internship, I concluded that I’m far more fascinated with Financial Markets. I also wanted room for creative expression, so I began looking for something that is an amalgamation of Sales & Marketing and Finance, set against the backdrop of the Financial Markets. Since I was looking for an extremely niche role, I kept my options open both on and off campus. One company I was particularly interested in was Bloomberg LP. They came on-campus for their Analytics and Sales Program, a comprehensive program that covers all financial assets and the Bloomberg Terminal, followed by a specialization in fixed income, equities, foreign exchange (FX), and/or commodities. The role begins with Analytics, where one assists clients with terminal navigation before transitioning into an Enterprise Sales Role, where one becomes the face of Bloomberg for various Financial Market players and clients. It was sales with a financial flavour to it, something I really wanted to do. I gave the preparation my all and managed to secure the job on campus. I will be joining the training class of August 2023 in Mumbai post my graduation.

FRM, CFA, CA and more: Did I do these certifications? How much did it help/hinder my journey in the field of finance?

I cleared CA foundation with distinction, and then dropped it. I realized it wasn't my thing. But I'm currently looking to pursue CFA since it aligns more with the field I am interested in. In my interviews with different firms, they didn't really ask me why I have no professional qualification since my profile more than made up for my lack of certification. I had 2 strong finance-related experiences with HUL and Finshots so it didn't act as a barrier at all.

From my experience throughout the process, a couple of tips I would like to give to finance aspirants are:

Know yourself and your CV inside-out (I found that a ‘Me Map’ which is basically a docudump outlining who you are, what your background is, what your professional experience is, what your values are, where you come from and where you wish to go, serves as a ready reckoner for interview prep for any company under the sun).

Spend a good amount of time researching the company and the role. It shows companies whether you’re truly interested in being there or if you’re just giving the interview forsakes.

Have a good knowledge of the fundamentals of the field you’re applying for. For Bloomberg, it was important for me to know the financial markets, where Nifty is at, what the current market sentiment is, what the Monetary Policy is, etc. For Financial Markets and Products understanding, I’d strongly recommend using Varsity by Zerodha. It’s a completely free resource that explains concepts in layman language and uses a lot of examples to elucidate. Bloomberg Markets is also a wonderful resource to keep up with the global markets.

Communicate well and communicate professionally. An interview is simply about convincing people that you’re the right person for the job, so the right articulation with the right confidence is incredibly important!

Be authentic. It’s crucial to be who you are instead of who you think the recruiter wants you to be. Recruiters want to understand the real you and see if you’re the right culture fit. There’s absolutely no point in faking it to make it.

Parting Note

There’s no single recipe for success. Everyone’s journey is different, and everyone’s takeaways from that journey are different too. It all boils down to understanding different perspectives, figuring out what works for you, and implementing that. That said, I leave you with a brief crux of everything I’ve articulated so far:

CV and Profile building: Build your profile catering to the role(s) you’re interested in breaking into.

Leverage your strengths: Leverage your skills to get you to where you want to be. There is no right answer or “one way” of doing things.

Hone your written and spoken communication: Communication is the biggest skill to have in today’s day and age. Especially as an undergrad, since we don’t have formal experience, our ability to market ourselves becomes our biggest asset.

Start-ups are a great place to start: While building your profile, try to join start-ups whose work you’re personally passionate about. Cold emails and LinkedIn networking are great ways to get in touch!

Experiment, experiment, experiment! : College is all about experimenting and finding yourself so make sure you give yourself a couple of experiences before you zero in on what you wish to do long-term.

Don’t self-reject. Many of us have the habit of not even trying simply because we think we aren't good enough or because we don’t have the right skills. In the end, we only regret the chances we didn’t take. Trust yourself and the process, sometimes the right attitude is all it takes!

Last but not the least, do what feels right for you: You’ll hear a hundred people tell you a hundred different things. Hear everybody out but stick to your guns and do what you think is right for you. It’s ultimately your story, and you should have the biggest say in how you wish to chart your journey!

And that’s about it. If you have any questions, need any help, or simply wish to chat, feel free to reach out to me on LinkedIn. Cheers!

This will be it for this week, see you next Friday. We wish you all a very Happy New Year in advance :)Best RegardsTeam FinOak