- The FinOak

- Posts

- How to Maximize Investment Potential with Flexi Cap Funds

How to Maximize Investment Potential with Flexi Cap Funds

Welcome, FinOak fam! How are you doing? We bring you an electrifying edition, chock-full of gripping updates that will leave you on the edge of your seat. Brace yourselves as we take you through the the recent resignation of Deloitte as the auditor of BYJU’s, and Goldman Sachs recent layoffs of managing directors. And, if that's not enough to pique your interest, we've also covered the about the investment opportunities offered by flexi cap funds. Lastly, read about the inspiring journey of Pulkit Sehgal who is an incoming associate at BCG and has also founded MakeSense, which is a mental health-focused startup.

Note: Please move this email to your primary inbox so that you don’t miss out on any update ;)

Column 1

Weekly Wrap Up

In This Edition:

1. BI-gone, BYJU’s & Deloitte’s Resignation

2. Goldman Sachs Slashes Jobs: Global Layoffs Target Managing Directors as Deal Slumps Take Toll"

BI-gone, BYJU’s & Deloitte’s Resignation

We all know someone who has opted to learn some course/topic from Byju’s. With the recent headlines, it seems like the days of misery are not ending for India’s most valuable startup–Byju’s.

Recently losing 3 key board members the company has received another blow as Deloitte has tendered to resign as Byju’s statutory Auditor with immediate effect, adding to its long list of troubles. A few days back Byju’s key board members tendered to resign over their disagreement with CEO Byju Raveendran over key operational issues. Of the people who tendered to resign are GV Ravishankar, Russell Dreisenstock, and Vivian Wu. Though the company is in talks with them to reconsider their decision. But such events explicitly show that all is not well in the company.

Now the news has come up that Deloitte, one of the biggest audit firms in the world, has tendered its resignation as the statutory auditor of Byju's and its Aakash Educational. Deloitte in their statement, said that the financial statements of the Company (Byju’s) for the year ended March 31, 2022, are long delayed. They have also not received any communication on the resolution of the audit report modifications in respect of the year ended March 31, 2021, and the status of audit readiness of the financial statements and the underlying books and records for the year ended March 31, 2022, and they have not been able to commence the audit as on date. They further added that there will be a significant impact on their ability to plan, design, perform, and complete the audit in accordance with the applicable auditing standards.

To handle the situation the company’s CFO has appointed BDO (MSKA & Associates) as the statutory auditor for the consolidated group commencing from FY22 for the next 5 years. BDO will also be the auditor to the IPO-bound Aakash Educational Services.

Deloitte's resignation leaves Byju's in limbo as the edtech company's FY21 (2020-21) results had outlined a number of irregularities with respect to the company's revenue recognition practices. Additionally, Byju's also had to defer about 40 percent of its FY21. Byju's had reported a surprise decline in FY21 revenue, which, otherwise, was a massive year for edtech companies in India and also globally, thanks to Covid-19's stay-at-home restrictions that gave a huge boost to online learning.

Byju's losses also mounted to over Rs 4,500 crore in FY21, making Byju’s seem like a company that claims to brighten children’s future through unconventional learning, its own future looks in jeopardy. Recent defaults on loans, questions of their operations and accounting, mass layoff, dwindling leadership, and now the resignation of the auditor has put a question mark on India’s most valuable startup.

Goldman Sachs Slashes Jobs: Global Layoffs Target Managing Directors as Deal Slumps Take Toll"

Goldman Sachs Group has started to cut down jobs as it is looking to let go of managing directors across the globe as the firm reduces its headcount amid deal slumps.

The group is looking to let go of about 125 Managing Directors, including some in investment banking, reported news agency Bloomberg citing source, who asked not be identified. Not all of the layoffs have happened yet, the people said,

This move by Goldman Sachs is a part of a deep cost-savings drive at the bank, which has seen at least three rounds of job cuts in less than a year.

Goldman Sachs and other banks had ramped up hiring in 2020 and 2021 amid a surge in M&A and initial public offerings are now grappling with falling fees as dealmaking sputters.

Deal values have fallen more than 40 per cent this year to $1.2 trillion, with Goldman Sachs the number two adviser globally, according to data compiled by Bloomberg. The last time the bank didn’t top the rankings at the halfway point of a year was in 2018, the data show.

JPMorgan Chase & Co. is terminating about 40 investment bankers as part of its effort to cope with the global slowdown, Bloomberg News reported Friday. Citigroup Inc. also started cutting hundreds of jobs across the company this year, and is planning to shed 30 investment-banking jobs and 20 more at its corporate bank in London.

In the past month, several Goldman Sachs veterans have joined competitors, including Wells Fargo & Co. and Banco Santander SA. Tech banking co-head and global head of semiconductors, Tammy Kiely, jumped to Evercore Inc., Bloomberg news reported on Thursday.

Column 2

Personal Finance

In This Edition:

Maximizing Investment Potential with Flexi Cap Funds

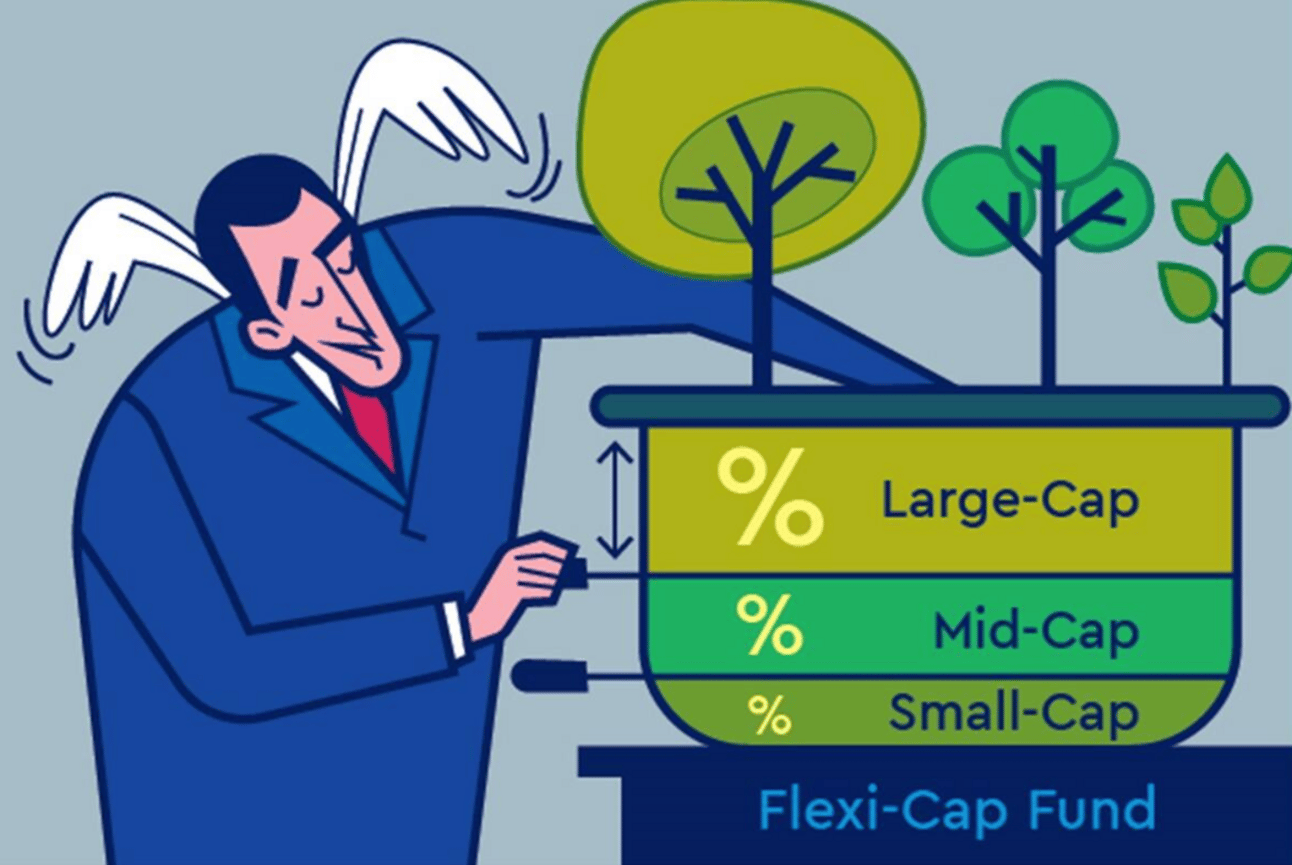

Maximizing Investment Potential with Flexi Cap Funds

For Indian-origin investors seeking opportunities in the dynamic world of mutual funds, Flexi Cap Funds have emerged as an attractive investment option. With their unique flexibility and potential for growth, these funds offer a versatile approach to wealth creation. In this segment of today’s Newsletter, we will dive into the concept of flexi-cap funds, their benefits, and how they can be a valuable addition to your investment portfolio.

Understanding Flexi Cap Funds: Flexi Cap Funds belong to the equity mutual fund category and are characterized by their flexibility in terms of asset allocation. Unlike other funds that adhere to a specific market capitalization (large-cap, mid-cap, or small-cap), Flexi Cap Funds have the freedom to invest across companies of varying market capitalizations. This flexibility allows fund managers to adapt to market conditions and capitalize on opportunities across the entire spectrum of the stock market.

Key Benefits of Flexi Cap Funds:

Diversification: By investing across market capitalizations, Flexi Cap Funds provide diversification benefits. This diversification reduces the risk associated with investing in a single market segment and enhances the potential for returns.

Dynamic Asset Allocation: Flexi Cap Funds enable fund managers to adjust the portfolio's asset allocation based on market conditions, valuations, and growth potential. This active management approach allows for timely allocation shifts to capture growth potential and manage risk.

Market Opportunities: Flexi Cap Funds can take advantage of emerging investment opportunities across large, mid, and small-cap stocks. This flexibility allows the fund managers to allocate funds to sectors and companies that show promise, irrespective of their market capitalization.

Potential for Long-Term Growth: By investing across the market spectrum, Flexi Cap Funds can capture growth from companies in various stages of development. This approach offers the potential for long-term capital appreciation, aligning with the goals of many Indian Investors.

Active Management Expertise: Flexi Cap Funds are managed by experienced professionals who actively research and analyze companies to identify investment opportunities. These fund managers strive to generate superior risk-adjusted returns by making informed investment decisions.

As a young investor, exploring flexi-cap funds can be a smart move to achieve diversification, long-term growth, and the potential for superior returns. These funds offer the flexibility to invest across market capitalizations and adapt to changing market conditions. By leveraging the expertise of skilled fund managers and taking advantage of emerging opportunities, Flexi Cap Funds can play a vital role in your investment journey.

Want us to cover any investment option of your interest? Feel free to write to us on [email protected]!

Column 3

Featuring Future Leaders: Pulkit Sehgal

From Social Impact to Consulting Excellence

Hello Everyone! I’m Pulkit Sehgal, an outgoing third-year student at Shaheed Sukhdev College of Business Studies, and I’ll be joining the Boston Consulting Group as an Associate. During my college days, I interned at Grant Thornton and Julius Baer, and have also founded MakeSense, which is a mental health-focused startup.

How I got to SSCBS

My main inspiration for SSCBS came from my school days – I would often hear about my seniors, who had gone to CBS and won several regional, national, and international case competitions. So, when you go to school, and hear about all these accolades that your seniors have achieved – it motivates you too, to work harder, to ace DUJAT, to go to SSCBS, and to achieve what you have seen others around you achieve.

I also liked how SSCBS had an external aptitude test: I think it provided a level playing field and played a big part in my developing my initial attraction for the college.

I had always had a flair for numbers and was pretty interested in business and finance right from 8th grade itself. My father is himself a chartered accountant and has spent more than 20 years in functional areas like finance and treasury. His work always fascinated me – hearing about big deals, or transactions of several crores was always an exciting prospect for me as a kid.

Work with 180DC in the NGO space

When I got into SSCBS, I primarily joined three societies in my first year – 180 Degrees consulting, IFSA Network, and Yuva, which is the Entrepreneurship cell of SSCBS. I had always been intrigued by and interested in the fields of social impact and welfare, and my time at 180DC really helped me develop in those areas better.

So, 180 DC is the world's largest student-run volunteer consultancy where you work for socially conscious organizations and startups. I worked on a number of projects at 180DC.

Save the Children

Save the Children was the first project that I worked on at 180DC, pretty much right after I got in. So, Save the Children is one of the world's largest child rights NGOs. My work primarily consisted of working with my team members to

1. Helping them onboard more volunteers, figuring out strategies on how to onboard more volunteers, and developing an incentivization structure for this

2. Figuring out a way of increasing the time of retention of these volunteers, and developing a structure that helped increase volunteer satisfaction.

After providing actionable insight to the head team of Save the Children, I moved on to We Listen

We Listen

We Listen is an NGO focused on destigmatizing mental health as well as providing support to the youth of the country with regards to mental health not by providing actual psychologists, but by training, normal people like us to be licensed listeners. We Listen was perhaps my favorite project at my time at 180DC, since mental health is a cause that is very close to my heart (more on that later!) Our work involved helping out We Listen with volunteer onboarding and creating an incentivization structure, as well as developing a feature pool for the official platform.

We also worked at marketing the services We Listen provides in a better, more targeted manner. We worked on devising strategies to improve content engagement, as well as brainstormed ways to increase social media outreach.

One of my core memories of the project is how at the end, the CEO of We Listen told us how he had been flabbergasted by how a bunch of first years, all of whom had little to no experience in the mental health sector, had been able to deliver work of such high quality. I still remember his words to this day.

Feeding India

Working at the Feeding India arm of Zomato was an entirely different experience – rather than being a startup or fledgling organization, Feeding India was the philanthropy arm of Zomato, which is already an established and successful business.

Our work was also different in scope – we primarily worked on developing a comprehensive CSR strategy and worked to achieve the company target of obtaining 10% of their funds from CSR avenues. So, Feeding India at that time was getting its funds primarily from individual donations or voluntary startup donations, but not from CSR by companies. Over the course of 5-6 months, we worked with the Director of Partnerships and conceptualized a strategy for them to do so.

So the main problem in this project was that there was not a lot of data about the specific CSR funds being used for Zero Hunger. We had to create a projection for how we can analyze and come up with a number of what this 10% would be in the first case, and then we sort of created a five-year projection to understand what this number could be. And then we gave various solutions, including you know, let's say using cryptocurrency as a means of donations after analyzing you know, its legal ramifications, et cetera

This was a really interesting internship, for a different reason. While the previous internships had always been closer to my heart in terms of the work they did, this was something that really stood out due to the scale of the impact we could have – if our strategy worked and led to increased CSR funds, we could impact thousands, perhaps even hundreds of thousands of people.

The Social Town

The Social Town was a project I did in my second year, and was a pretty long project – it easily lasted from 6 to 7 months.

The Social Town was basically a nonprofit company that was creating a platform, similar to LinkedIn, but for the social sector. So, what they were trying to do was to pull all sorts of different resources, which are available in the social welfare sector, and bring them into one place. So that includes if anyone wants to look for volunteering opportunities, if any NGO wants to post volunteering opportunities, if any NGO wishes to get funds, if any company wishes to donate funds along with various learning resources – all on one platform.

180DC basically worked to create a pricing model for the platform – working to help them raise more money, as well as how to increase volunteer registrations on their platforms.

My corporate internships, and what they taught me

Experience at Grant Thornton

While my time at Grant Thornton was not due to 180DC and was actually an off-campus internship, I worked in the social and sustainability sector even at Grant Thornton. Now, at Grant Thornton, my work was primarily twofold:

1. Research various medical projects of leading public health agencies, and public health agencies in India to understand and identify the different funding trends across geographies and subject areas. So, it majorly involved analyzing a lot of medical research projects to understand which projects are getting money, which projects are good, not getting funded, et cetera.

2. The second part of the internship was on the audit side – it involved me auditing several major NGOs, that were funded by some of the biggest donors in the world. While the scale was quite big and the impact was possibly large, my experience taught me that perhaps auditing is not really the right place for me. That being said, it was still a great first corporate experience.

A frequently asked question: Does social sector XP help in getting into consulting

I get this query quite frequently from my juniors because I think people often look at internships and opportunities in the social sector as a launch pad for your corporate career and a way to get some social experience on your CV.

One thing I always did, was to focus on working in the social and impact segment simply because I enjoyed it, because I liked the change we could make and because it actually helped shape and improve the lives of people. While firms like BCG do look favorably on social experience, I would strongly dissuade someone from going for such an experience just for the sake of it.

Consulting firms might look upon such experience favorably, but that doesn’t mean that nobody makes it to the shortlist without any social sector experience. Not everyone has a calling for social impact, and that’s ok – for consulting, you should instead focus on finding your niche and excelling at it (this will add spikes to your CV) and also on developing business problem-solving skills by going for case competitions and interning at different places (this will help in the interview)

Foraying into wealth management with Julius Baer

Julius Baer is a Swiss private bank, which also operates in India. It primarily caters to high-net-worth individuals and ultra-high-net-worth individuals with regard to their wealth management needs.

I worked on two main research projects there:

a) The first project, due to my experience and expertise in the social sector, involved me working on the incorporation of ESG metrics for evaluating equity and fixed-income securities. So ESG is not something they had been actively using as a metric until then, and they were evaluating whether it should be a part of the decision-making process when they decide whether they want to invest in a specific equity instrument or a fixed income security.

b) Secondly, I also worked on the defense sector - analyzing the various trends of the industry, analyzing various trends of the economy at the moment, and at the end of the day, coming up with some prospective investment opportunities for Julius Baer.

While the tasks were themselves extremely fun and provided some great learning opportunities, my actual learnings from Julius Baer were on how to approach people, and how to interact with HNWIs and UHNWIs. What I realize now is that private banking or wealth management is more of a sales game than it is a finance game - because you're basically trying to sell your services to these extremely wealthy individuals.

The actual finance part, is something any bank can do. What separates an exclusive bank like Julius Baer from a general commercial bank like ICICI is how they take care of and interact with their clients – and that’s actually 70-80% of the wealth banking game right there.

I worked under a senior relationship manager at the firm who was handling clients with net worths of greater than 1000 crores himself, and I used to observe how he would interact with these HNWIs and UHNWIs. Those learnings that I imbibed, and the soft skills that I actually developed, continue to help me on my professional journey forward.

Case Competitions: How to participate, and how to win

Case competitions are one of those unique college experiences that I believe everyone should try at least once.

What such competitions do, is that they put you in a fast-paced, dynamic environment along with some really smart and ambitious peers. While it is pretty well known that they help you develop research skills and push you out of your comfort zone and make you explore new business environments, case competitions also play a key role in the development of soft skills and a holistic personality. When I went for my first case competition, I quickly realized that while I was pretty good at the research and the number side, I had room to improve in the soft skills section. So, my case competition journey wasn’t just a process that added value to my CV – it also helped me be comfortable in front of an audience and added value to my personality.

Experience at HSBC Case: Bagging global rank 2

The Global HSBC Case Competition is a little bit different from other competitions – unlike other competitions that go on for 1-2 days, the HSBC case easily runs for 5-6 months. The only catch? Everything has to be done by hand – I still remember how we had to prepare our decks by hand, and draw headings and borders on sheets of A4 paper. There’s no PowerPoint allowed, there’s no internet allowed – it’s just you and your team, your case, a couple of A4 sheets, and some stationery.

The competition starts with a video round, where you and your team have to prepare a three-minute video with regards to which highlights who you are as a team, your achievements, your profiles, etc. The second step is an aptitude test.

Both of them sort of lead you into the next round, which is a case-solving round. So, this round has about 60 teams all over India, and we’re all given a case. So, in a time constraint of 4-6 hours, you have to read and analyze the case and prepare a handwritten hand and hand-drawn deck. And then even during those four hours, you have to record a 15-minute video. And then you have to upload it along with the solution. It gets pretty hectic, as the cases increase in complexity as your progress in your rounds.

So, after this round, there was a top 6 round, followed by a top 4, and then finally a top 2 national round. All rounds followed the same structure, but they increased the level of difficulty and marking criteria with every successive round. After we placed first nationally, there were 3 more rounds at the global level. The structure was the same – 4 to 6 hours and hand-drawn decks, but it was the level of competition, as well as the complexity of the cases that made it a truly challenging competition.

Societies: How much do they matter, and they impacted me

I was a part of two societies at CBS : 180 Degrees Consulting, which I’ve already talked about, and the IFSA network.

My general opinion with regard to societies is that they can be quite subjective in the type of experience they provide. Not every society provides value and learnings to its members, but I was still lucky to be a part of two societies that do.

My time at 180DC

Since I’ve already detailed the projects during my time at 180DC, I’ll now talk about what I actually learned from my time there:

a) It helped me improve my consulting profile, considering I had a lot of research exposure and a lot of consulting exposure on my profile, which helped me bag the initial shortlists

b) It provided exposure to different business areas and gave me a lot of research expertise, which I was able to demonstrate in my BCG interview

c) The most important thing that I got out of 180DC, was that it helped me become a better communicator. During my time at 180, I was able to interact with so many different stakeholders – I could be interacting with the founder of a budding startup based in rural India and could be on a video call with a 180DC chapter in Amsterdam the very next day.

Learnings from IFSA

My time at IFSA also helped me develop, but in a starkly different manner. It wasn’t the projects or the experience at IFSA that necessarily helped – it was the people. At IFSA, the people around me were true go-getters - they were always going for and winning case competitions, mock stocks etc. The atmosphere at IFSA constantly kept me on my toes and acted as the perfect catalyst for my growth – it drove me out of my comfort zone, and it motivated me more than it intimidated me.

Getting into consulting, and how to crack MBB

If you ask me, management consulting is one of the best first jobs you can get out of college. Why? because you (1) build a core foundational toolkit, (2) learn from exceptionally smart people, and (3) are exposed to a fast-paced business environment

The process at BCG

The main evaluative steps for consulting firms are twofold, the CV part and interviews, and there are three major things that go into consulting interviews:

a) The problem-solving aspect: This mainly involves the actually case-solving part. Cases are basically business problems or other problems, where they expect you to interact with the interviewer and solve the problem in a very structured way by asking different questions. For example, the case problem is that there is an ABC Company, which is facing a decline in profitability by 20%.

And throughout the next 20-25 minutes, you're supposed to interact with the interviewer to gain and ask specific questions to gain insights about the problem, and then solve the problem in a very structured way. It’s not like you can just give them an answer and they’ll be satisfied - that's not how it works. You have to work with them and be extremely structured in the questions that you ask and the solutions that you give.

[From the FinOak team: We’ve put three example cases that Pulkit himself talked about at the end, see if you can solve them. Mail your solutions back to us, and the best solution gets a shoutout on our Insta page!! ]

b) The HR stuff: This is one of the most overlooked, yet a very crucial and important part of your preparation. It essentially involves questions as simple as your introduction to your motivation to work in consulting, working at BCG, and other similar questions that sort of help them understand who you are as a person.

HR questions could be like - tell me about your biggest failure in life. Tell me about, your weaknesses, your strengths, etc.

And the primary part of answering these questions is basically that you need to highlight problems. At the same time, you also need to highlight how either you've worked on them, or you're currently working on them because you can't highlight problems that you can't do anything about.

c) Your CV: They also ask you questions about your profile. They want to make sure that whatever you've written, you actually know all of that, and you've done all of that. So, they want to talk about your experience – your societies, the places you had your internships at, the competitions you went to etc.

Helping others make sense with MakeSense

As I said before, mental health is a cause that is very close to my heart, and one that I feel is very often neglected in college spaces. I've seen a lot of people facing a lot of issues in and around mental health, but they're just too scared to admit it due to the general level of stigma around mental health and even stress and anxiety - people just don't admit that and sort of keep it within themselves and maintain that facade that everything is fine - when it’s actually not. So MakeSense began as a platform that aimed at destigmatizing mental health and providing mental health support to college students. And the way we're doing it is twofold :

A) One, through a mentor-mentee system for college students, by college students. So, our initiative essentially aims at connecting seniors and pass-outs from several colleges to juniors and incoming freshmen in the very same college. We mainly want to connect juniors with alums who can guide them through the issues that they're facing, especially college-related issues such as internships, placements, time management, handling society rejections etc.

B) The second idea is around providing pro bono counseling services to folks at the undergraduate level. And the idea basically revolves around, you know, trainee therapists.

Trainee therapists are basically master's students who are compulsorily required to provide pro bono therapy services in their final year. So, we realized that there are people who need to provide therapy as part of the curriculum, and there are people who need therapy. So why don't we just connect the two? And that's something that we're trying to do right now. And that's something that we hope to release soon.

Parting words

One piece of advice that I would give for people joining college, is to seek a lot of discomfort. If public speaking is an issue, just go out in front of 1000 people, if you get an opportunity and talk about something. Try to seek a lot of discomfort, whatever that discomfort is.

Firstly, analyze what makes you uncomfortable, and then just try your hand at it. This is the perfect opportunity where you get to get out of your comfort zone and learn as much as you can and take a lot of risks. Only when you go out there, try your hand at something new, and push yourself out of your comfort zone can you actually learn, grow, and develop.

And that’s about it. If you have any questions about my journey, need any help with breaking into finance or just want to chat, feel free to reach out to me on LinkedIn ; I’ll be happy to help :) Till then, all the best for your professional journey!

This will be all for this week, see you next week :)

Team FinOak