- The FinOak

- Posts

- People see success but not your hurdles. Ft., Messi and Aryan

People see success but not your hurdles. Ft., Messi and Aryan

People see success but not your hurdles. Ft., Messi and Aryan

Hello, FinOak readers! We hope that you enjoyed our last edition and we promise that this edition is even more intriguing.Scroll down to read about finance happenings and personal finance tips, but, no it doesn't end there! We have a special feature of one of our own who made his way to Bank of New York right after graduation! Read his story in 'Featuring Future Leaders' column. Enjoy!

Column 1

Weekly Wrap Up

In today’s Edition

Inflation scare in Argentina

Reliance's new acquisition

1. Messi wins but a worry for the nation

The world cup win was a fairytale ending to Messi’s journey and was a moment of joy for the people of Argentina. The streets of Buenos Aires were flooded with people who after such a long time had something to rejoice as they danced all day to celebrate the success of their national football team.

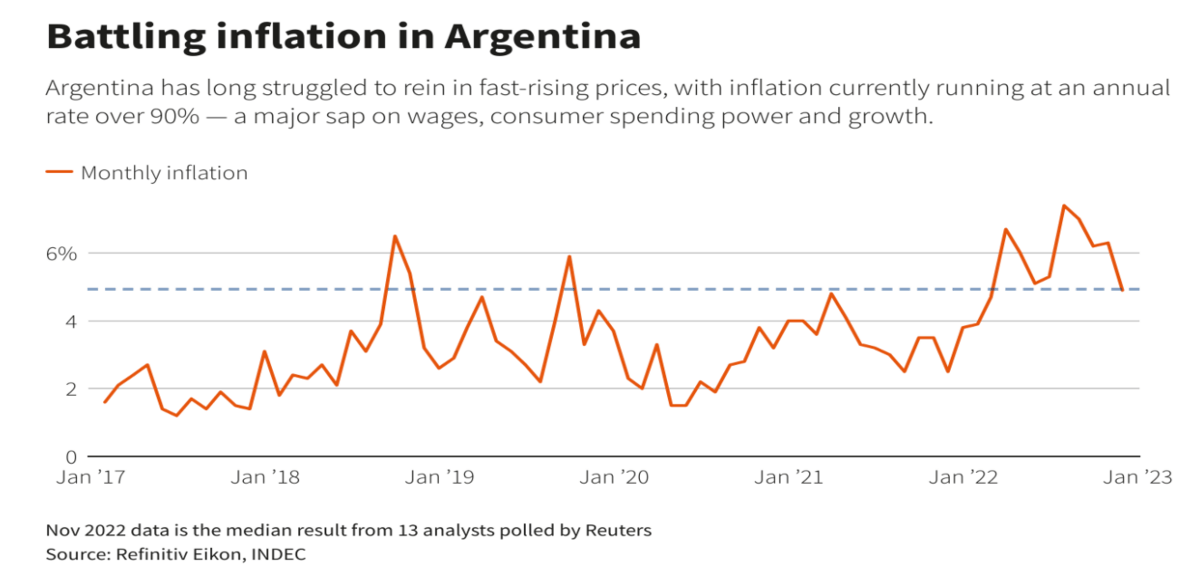

It was a feeling of joy for a crisis hit nation where people are facing an all-time high inflation rate which will touch nearly 100% as real wages lag, increasing social distress and leading to a record level of protests so far this year.

But the question arises,

How did the South American nation land in such an economic crisis?

It is not at all surprising for a nation who has faced various economic crashes in past decades. However, this situation is more worrisome now as the savings of middle class people is rapidly wiping out. Poverty in the country is at an all time high of 40%. Due to less cash, people are cutting back their expenses on the food they buy.

The inflation rate is taking a toll on the consumer spending power and growth thus weakening the market situation. Consumer prices rose 88% in October from a year ago, highest among G20 nations.

The measures taken by the government such as restriction on the country’s main commodities like agricultural goods have only aggravated the situation according to the critics.

But is there a hope for recovery in Argentina?

Despite many years of economic depression, political mishandling and rampant corruption cases, the South American country retains a lot of potential thanks to

Fossil resources like gas — with the "dead cow" field in Patagonia being the world's second-largest shale gas reserve

Lithium, which is a key component for batteries in electric vehicles and electronics. Western leaders like German Chancellor Olaf Scholz have already expressed interest in supporting Argentina in exploiting those resources.

International Trade deal

Moreover, next year could also see the ratification of the long-delayed trade deal between the EU and the Mercosur bloc — comprising Argentina, Brazil, Uruguay and Paraguay — which now looks more likely as Brazil's new President Lula da Silva has vowed better protection of the Amazon rainforest.

Optimism for the deal has also grown as Russia's war against Ukraine and growing tensions with China have led to a change of mind among many European politicians who have long opposed the deal but now see the need to forge closer ties with democracies in South America.

Advocates of the deal say that it would tear down protectionist barriers in Argentina and its neighboring countries and open new opportunities for investment and growth. Change could also come at the national political level, as Argentina will hold general elections in October next year in which the left-wing government is set to be challenged by more market-friendly candidates from both a center-right bloc and a new liberal party.

2. Mukesh Ambani acquired German firm Metro AG’s India Business

On Thursday morning before the stock market bell rang business media houses were storming with the news that Reliance Retail Ventures Limited, the retail arm of Reliance Industries has signed the definitive agreement to acquire 100 % stake in Metro Cash and Carry Limited, the wholly owned subsidiary of Metro AG.

Metro cash and carry is the wholesale division of Metro AG. It entered India in the year 2003 and after nearly 19 years of operations with almost 31 stores all over India is been sold to Reliance in an all-cash consideration of Rs 2850 crores.

Metro Cash and Carry India worked under the B2B market segment with a cash-and-carry business model. This means, registered business customers, visit a Cash & Carry outlet, select their own purchases and carry these back themselves instead of placing orders with multiple vendors.

METRO Cash & Carry India’s core customers include small retailers and Kirana stores, hotels, restaurants, caterers (HoReCa), corporates, SMEs, all types of offices, companies, and institutions, as well as self-employed professionals.

The company had a reach of over 3 million B2B customers of which 1 million are frequently buying customers, through its store network and eB2B app.

FY ended September 2022 became the highest revenue-generating year for Metro India (since 2003) as the company generated a top line of Rs 7700 crores.As per Reliance's regulatory filing this acquisition is expected to help Reliance Retail’s physical store footprint and the “ability to better serve consumers and small merchants by leveraging synergies and efficiencies across supply chain networks, technology platforms and sourcing capabilities

The acquisition comes days after Reliance Consumer Products, the fast-moving consumer goods (FMCG) arm and a wholly owned subsidiary of Reliance Retail Ventures launched its consumer packaged goods brand, Independence, in Gujarat.

In recent times we have seen that Isha Ambani-led Reliance Retail Venture has been aggressively acquiring and investing in retail brands strengthening its presence in the FMCG sector and targeting Indian households. All the way from acquiring dozen of brands for $6.5 billion to investment in Jio stores, Jio Marts, and Reliance Malls.

Column 2

In today’s Edition

ELSS Funds, what are they?

Precautions for practising safe banking and protection from frauds

1. ELSS Funds, what are they?

In our last edition, we talked about section 80C of The Income-tax Act wherein we discussed how this act provides a certain deduction on total taxable income if we invest money in certain investment avenues and schemes. Of all the avenues mentioned, ELSS is the most renowned and preferred scheme by the taxpayer.Let's dig deep into it.ELSS or Equity Linked Saving Scheme is nothing but a mutual fund with a core feature that investment in this fund provides taxpayer benefit under section 80C.ELSS funds invest 75-80% of their corpus fund into equity and equity-linked securities. Besides this, the fund include minor allocation in fixed-income securities. This allows them to generate inflation-beating returns in the long run.

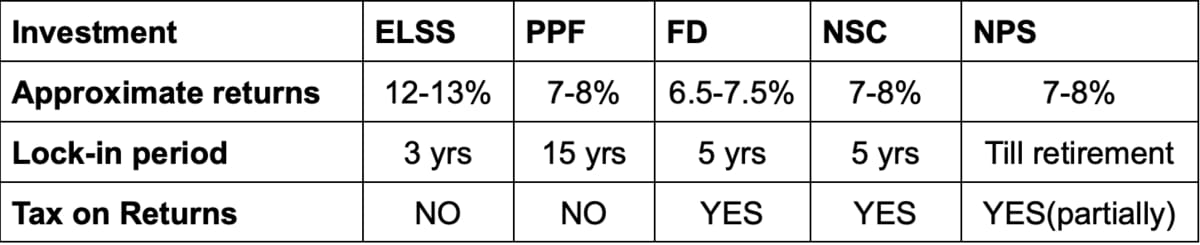

Comparison between ELSS and other investments allowed in section 80C:

As we can see, of all the major investments under the purview of section 80C, ELSS provides the highest return with the lowest lock-in period. The Lock-in period is the compulsory time span you have to stay invested in the plan. You can not withdraw your money prematurely.

However, there is no limit on your investment horizon i.e you can continue to stay invested in ELSS beyond the compulsory 3-year span.Tax on ELSS income

Also, income from ELSS (i.e dividend) is completely tax-free in the hands of investors.

However, appreciation on your investment will be considered as ‘Long Term Capital Gain (LTCG)’, and profit above Rs 1 lakh would be taxed @10%.

You can avoid this by booking your profit in an amortized manner. Eg. if your investment generates a profit of Rs. 2 lakhs in 3 years then rather than booking your entire profit in a single financial year what you can do is you can book Rs 1 lakh in one year and other Rs 1 lakh in the next year. In this way, you can save your LTCG tax.Mode of investmentThere are two ways through which you can invest money in ELSS or in any mutual fund in general. They are,

Lump sum method

or SIP method

As the name suggests, In the lumpsum method you will invest an entire amount in the fund in one go. Whereas in SIP you regularly invest small amounts in the fund in a fixed interval of time. SIP provides two benefits - First, It mitigates the risk to time the market. Second, It is more budget-friendly since you don’t have to invest a big amount in one go.

Top ELSS funds and how to choose them https://groww.in/mutual-funds/category/best-elss-mutual-funds

Visit the given link and look for the top ELSS mutual fund best suited to you.

While choosing a plan check for the following parameters:

Your financial goals: Your investment plan should align with your financial needs/ goals in the future

Your risk Appetite: Are you comfortable enough to take risks for high returns? Do your lifestyle and financial commitments allow you to take high risks?

Expense Ratio (% of your investment that will go for the fund’s maintenance): Lower the merrier

Fund’s Past Performance: Check whether the fund has been successful in generating returns for previous investors. Are these returns consistent or not?

Fund Manager experience: Well you surely don’t want to give money to a naive or inexperienced fund manager to play with. So check whether the fund manager is competent or not.

2.

Precautions for practising safe banking and protection from frauds

(Call from an unknown number)

Tring Tring Tring ………..You cut the callTring Tring Tring ………..You cut the call againTring Tring Tring ………..This time you accept the call and say hello but no response from the other side 10 seconds later you get a message that Rs.50 lakhs has been debited from your account. Well it seems impossible since the person hasn’t shared any password/or OTP, he just accepted a call and in seconds his bank account got wiped out.

Unbelievable as it may seem but this is exactly what has happened with a Delhi-based person recently.

These types of news regarding banking fraud and bank account hacking are not unfamiliar to us (but surely the methods are). We hear such news on regular basis and remind ourselves that never to share OTP and bank details with others. We think that if we follow this then our hard-earned money will be safe but the news above surely doesn’t prove it.

As per RBI data on frauds reported by Scheduled Commercial Banks (SCBs) under the category “Card/Internet- ATM/Debit Cards, Credit Cards and Internet Banking" online frauds has come down to Rs 128 crores in FY’22 from Rs 185 crores in FY’19.Further according to the National Crime Record Bureau for the year 2018 to 2020, 16450 cases were registered regarding OTP, ATM, Debit/Credit card, and online fraud and out of them, 8981 cases were disposed of.

Surely these numbers are not convincing enough to make you feel secure. The safety of our money is our responsibility and we have to be a bit extra careful and aware enough to ensure that we do not fall into these online fraud traps.

So let’s learn how can we prevent online theft and make our accounts safer.

Regularly change your bank password: Try to use combinations of alphabets, numbers, and special characters. Such passwords are very difficult to hack

Do not use public computers and devices to log in: There is a high chance that your details will get stored in it. In fact, we have been listening that public chargers are usually bugged by scamsters that transfer your data into their servers

Do not fall prey to Phishing: In the guise of cash back, prizes, or other incentives, the fraudster can pose as a bank employee checking in for your bank details or OTP. You should avoid clicking or responding to any questionable links or phone calls that could aid hackers in gaining access to your bank account

Don’t save your banking information on any website or app: People today save their Debit/Credit card details on common apps like Flipkart and amazon just to save some seconds but these details are very crucial and vulnerable. So try to avoid it since we know how big tech companies have been in past accused of selling customer data to other parties

Avoid picking up spam calls: Use apps like Truecaller to know who is calling you or whether the calling person is genuine or not. (make sure that you don’t allow truecaller too to process your data. This can be done by managing your app settings)

Put a third-party transfer limit on your bank account: If you are a person that rarely do big bank transfers then it is advisable to put a limit on third-party transfer. In this way even if your account gets hacked, the hacker won’t be able to take more than the specified limit and if he tries to increase the limit then he has to go through an authentication process (OTP). This gives you time to block payments from your account.

Never share banking OTP with anyone

Take Cyber Insurance: Cyber insurance provides cover against theft of funds and identity, unauthorised online transactions, and email spoofing.

Got scammed, report it immediately: Even if you get scammed make sure you report it immediately to the police/ or cyber police cell. The earlier you report, more will the probability that you get your money back. Savdhaan Rahe, Surakshit Rahe.

Column 3

Featuring Future Leaders: Aryan Gautam

From graduation to the Bank of New York Mellon

Hey everyone, I’m Aryan Gautam and today I’m going to discuss how I ended up in the field of Investment Banking straight after my graduation.

Most students who aspire to have a career in finance wish to land a role in Investment Banking, but are unclear on how to do the same. The journey to get into an investment bank is not a cakewalk. Just like any other goal, you need to have a good road map and a proper execution plan.

I completed my BBA from IP University in 2022. Since I was excited to explore finance, alongside my graduation I started looking up for certifications that can really add value to my profile and help me learn core concepts used in the industry. There are a lot of certifications that students can pursue (other than the regular certifications from platforms like Coursera and Udemy which are good starters but do not add much value in your CV) in finance such as a CFA, CAIA and FRM, but these certifications require a lot of time commitment and are expensive. So before taking up a decision to pursue these big certifications, I decided to do small certifications in order to build my interest and to check whether I can pursue finance as a career option or not. NCFM (offered by NSE) and NISM (offered by SEBI) offer small certifications in various finance topics such as financial markets, mutual funds, options strategies etc. These certifications generally require a few weeks of preparation and then you can give the exam. In the process I ended up completing a lot of NCFM certifications in Derivatives and also finished their financial modeling course. After that, I decided to take up the FRM course next. Simultaneously, I was also working on learning various tools such as Microsoft Excel and Tableau as these tools come in very handy in most of the finance roles.FRM JourneyFRM is considered to be one of the most difficult certifications one can pursue in the field of finance and this certification deep dives into various risks forms an organization is exposed to. It has 2 levels and I gave L1 in July’21 and L2 in May’22.

At the very beginning of the preparation, I was a bit scared because it was taking some time for me to grasp the topics but my sole motto was to get stuck to the point till the time I don't get a fair idea about it. Since I was studying all on my own and I was never a big fan of making my own notes, the only option left for me was to study Schweser Notes rigorously and my time frame was to finish off the topics by the end of May. Once I was done with my syllabus, I solved question banks and gave a few mocks. Since this is a professional exam, one needs to be well versed with concepts to crack it and the biggest weapon is self-belief to keep one motivated and that was one prime reason I could ace it. Similar strategy was used for both L1 and L2.

If you want to read more about certifications like CFA, FRM and CAIA etc., you can visit https://300hours.com/LinkedIn networkingIn this journey to end up at a big IB, it was very important for me to know how to network on platforms such as LinkedIn and learn from people in the industry. I read multiple articles and watched a lot of videos on the Internet on how to network on LinkedIn and how I could ultimately land an interview invite to organizations where they are working currently. Networking on LinkedIn was something very important because let's just agree that all our efforts would go in vain if we don't end up getting an interview invite for which we were working very hard for during our college days.

Important takeaway – Learning how to network effectively can boost your chances to get interview invites from your connections.InternshipsOne's clarity of what career they wish to pursue is significantly shaped by their internship experiences. Students and recent graduates' benefit from real-world exposure to working contexts, as well as the development of skills essential to stand out in a crowded job market. In my case I was lucky enough to be able to work at a good organization and in a good role at the same time. I worked for Evalueserve in their ESG team where I worked on a project with London Stock Exchange. But at the same time while a lot of people try to do internships in their first and second year, I did my internship in the final year.

Important takeaway - In your first internship, you should always prefer the role over an organization brand name, and you can target good brands subsequently in your next internships. Also give preference to the domain that you’re planning to build your career in be it finance, sales or marketing etc.Receiving multiple offers and my first JobAfter working on building my profile in 3 years of my undergrad, it was time for me to look for jobs both on and off campus. During those 3 years I did 1 internship, completed FRM certification, simultaneously did NCFM certifications, worked for multiple societies, maintained a high 9.5+ CGPA and also Co-founded FinOak. Fortunately, I was able to get multiple interview invites and offers from firms like Tata International, Moody’s, S&P, Invesco, and The Bank of New York Mellon.My Role at The Bank of New York MellonI eventually took the offer from The Bank of New York Mellon and I am working from their office in Pune. My role is into CDO/CLO deal modeling for EMEA Regions. I learned about CDO/CLOs during my FRM as well, and this knowledge helped me crack the interview. It is a middle-office role where we model new deals as well as work on maintenance of existing deals that would be used for CDO/CLOs in the markets.My typical day involves modeling new deals, making changes to existing models as per the needs and keeping in touch with the collateral service managers in the EMEA regions regarding functioning of the model we created, working on documents etc. It has been an amazing experience at the company so far and I am preparing for GMAT simultaneously.Ending NoteThe hiring procedure in investment banking is extremely formulaic. The secret is to comprehend the procedure and check every box without making any crucial errors. This involves keeping your resume to one page, maintaining a respectable GPA, acquiring relevant work experience, and showcasing your ability to politely respond to both technical and behavioral inquiries.

Few Important takeaways to get into good finance roles,

1. Learn how to network – Leverage LinkedIn2. Try to get some practical exposure in your domain by doing internships and live projects3. Learn theoretical and practical concepts used in the industry to be well prepared for interviews4. Take some certifications that are valued in the industry such as CFA/FRM/CAIA

There are ultimately no true short cuts; you still need to put in the effort to be well-prepared. If you have any questions, feel free to reach out to me on LinkedIn.

This will be it for this week, see you next Friday.Best RegardsTeam FinOak